Decoding Cryptocurrency Volatility Insights from a Quantitative Analysis of Bitcoin and Ethereum

30 October, 2024

In this article, we explore the multifaceted nature of volatility in leading cryptocurrencies, with a spotlight on Bitcoin and Ethereum. Our analysis covers essential aspects: the standard deviation and variance of returns, autocorrelation in both absolute and squared returns, return beta relative to Bitcoin, and the leverage effect linking returns with volatility. Additionally, we investigate calendar effects, like "hour of the day" and "day of the week" patterns, which unveil unique temporal trends distinct from those observed in traditional asset classes.

Our findings confirm that many established patterns, or stylized facts, from conventional financial markets—such as equities and foreign exchange—also apply to cryptocurrencies. Volatility clustering and the leverage effect, where negative returns often lead to heightened volatility, both appear within crypto returns. Yet, cryptocurrencies display distinct characteristics, such as persistent "hour of the day" and "day of the week" effects. These trends suggest that unique structural features, like 24/7 market accessibility and global investor participation, drive crypto volatility in ways unparalleled by traditional assets.

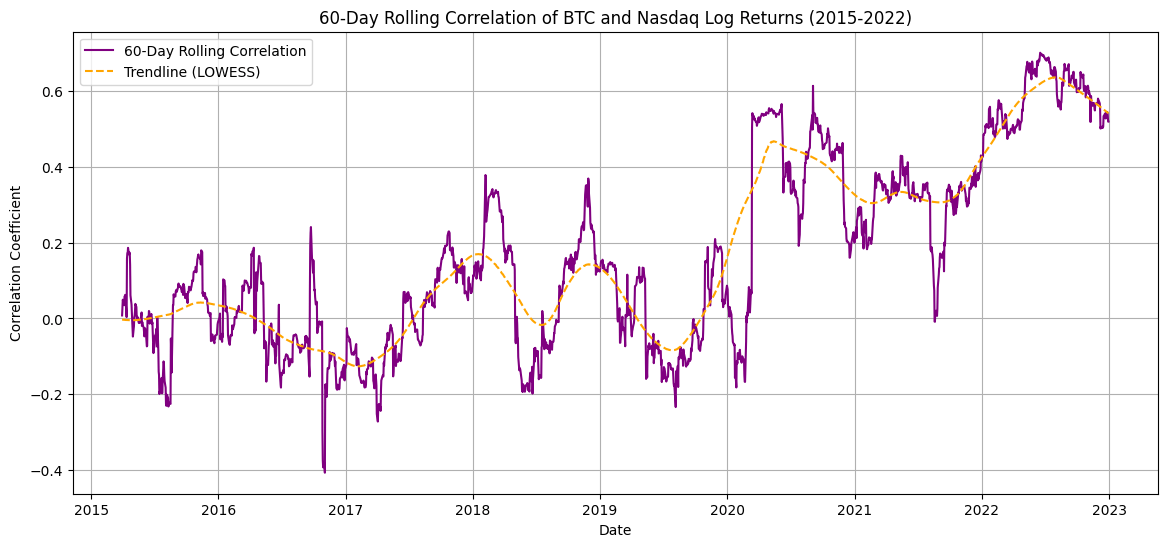

We also note a rising correlation between cryptocurrency returns and major equity indices, particularly the Nasdaq. This trend suggests a deepening link between cryptocurrencies and traditional financial markets, indicating that digital assets are no longer as isolated as once thought. This shift signals a significant evolution in the financial ecosystem, as cryptocurrencies become increasingly embedded within the broader economic landscape.

Introduction

Cryptocurrency markets are renowned for their heightened volatility, which has profound implications for both risk management and portfolio strategy. The market for digital assets has rapidly gained prominence, driven by explosive growth, increasing institutional interest, and a unique volatility profile that challenges conventional investment paradigms. This volatility, while often seen as a source of risk, also presents unique opportunities for investors. BlackRock's increasing institutional interest signifies a substantial commitment to providing institutional investors with exposure to cryptocurrencies, reflecting the growing acceptance and integration of digital assets into mainstream finance. To leverage these opportunities while managing risk effectively, a thorough understanding of cryptocurrency return properties is essential. In this study I aim to fill this gap by analyzing Bitcoin (BTC), Ethereum (ETH), providing comparisons to traditional assets such as equities, gold, and currency indices.

Cryptocurrency Returns Properties

The study of cryptocurrency returns reveals several distinctive characteristics. Lets look at them closer.

1. Fat Tails

Cryptocurrencies exhibit significant leptokurtosis, or "fat tails," which means that extreme returns are more probable than a normal distribution would suggest. This tendency is crucial for portfolio managers, as conventional models often underestimate the tail risk inherent in these markets. Our analysis of Bitcoin and Ethereum returns, summarized in Table 1, demonstrates kurtosis values almost three times those of traditional equities, underscoring the need for more robust tail-risk management strategies in cryptocurrency portfolios.

2. Volatility Clustering

Large price swings in the cryptocurrency market are typically followed by subsequent large movements, whereas smaller changes are often followed by further small shifts. This phenomenon, known as volatility clustering, is clearly evident in the time series data, and it provides a valuable foundation for applying GARCH-based models. While such models have shown promise in forecasting cryptocurrency volatility, their calibration requires caution. The frequent and substantial shocks in the crypto space can disrupt clustering patterns, making it challenging to maintain consistent predictions.

3. Historical Example of Gain/Loss Asymmetry

Our findings also highlight gain/loss asymmetry, where negative returns are usually followed by higher volatility. This asymmetry presents a unique risk exposure during downturns, suggesting that hedging strategies should consider volatility’s asymmetric response to losses versus gains—a factor that remains underdeveloped in traditional financial models.

Table 1. Gain/Loss Asymmetry for BTC and ETH

| Metric | BTC | ETH |

|---|---|---|

| Peak Day | 12/17/2017 | 1/13/2018 |

| Peak Price | $19,783.00 | $1,420.00 |

| Trough Day | 12/15/2018 | 12/15/2018 |

| Trough Price | $3,194.00 | $80.60 |

| Recover Day | 1/8/2021 | 1/8/2021 |

| Recover Price | $41,947.66 | $1,468.40 |

| Drawdown | -83.8% | -94.3% |

| Peak-Trough Duration | 1095 days | 1095 days |

| Recover Duration | 757 days | 760 days |

BTC experienced its peak price of approximately $19,783 on December 17, 2017, followed by a trough of about $3,194 on December 15, 2018, leading to a drawdown of approximately -83.8% over a duration of about 363 days before recovering to approximately $41,947.66 by January 8, 2021, over a recovery duration of 757 days.

ETH peaked at approximately $1,420 on January 13, 2018, reached a trough of about $80.60 on December 15, 2018, with a drawdown of approximately -94.3% over a duration of about 336 days before recovering to approximately $1,468.40 by January 8, 2021, over a recovery duration of 760 days.

4. Absence of Return Autocorrelation but Persistence in Volatility

Although cryptocurrency returns show little autocorrelation, their absolute and squared returns maintain significant autocorrelation, signaling that while return directions are unpredictable, their magnitude (volatility) is more consistent. This distinction creates opportunities for volatility-based trading strategies where, despite the lack of predictable returns, traders can anticipate shifts in volatility.

Understanding these stylized facts of cryptocurrency volatility is vital for managing exposure effectively and for building robust models that forecast market behavior. These insights carry profound implications for investors; for example, the prevalence of fat tails in crypto returns suggests that large one-day price shifts are more common than in traditional assets, affecting hedging and risk management strategies significantly. Recognizing volatility clustering is crucial for traders who can anticipate elevated volatility following high-volatility days, while grasping gain/loss asymmetry is essential for investors who rely on volatility derivatives to hedge crypto portfolios effectively.

Empirical Validation of Stylized Facts

To validate these stylized facts empirically within the cryptocurrency market, I calculated the statistical properties of returns using data from Bitcoin and Ethereum. By applying kernel density estimation to the returns and fitting a normal distribution for comparison, we highlight the unique distributional characteristics of these assets. As shown in Table 2, the distribution metrics for Bitcoin and Ethereum returns demonstrate significant deviations from a normal distribution, confirming that these returns are characterized by "fat tails" and leptokurtosis.

Table 2. Comparison of Hourly Returns Distribution Metrics for Bitcoin and Ethereum.

| Metric | BTC | ETH |

|---|---|---|

| Inception Time | 11/1/2014 | 8/1/2017 |

| End Time | 4/1/2022 | 4/1/2022 |

| Count | 65,000 | 51,000 |

| Mean | 0.64 | 0.96 |

| Std. Dev. | 0.81 | 1.08 |

| Skewness | -0.51 | -0.30 |

| Kurtosis | 30.81 | 20.82 |

Universe and Summary Statistics

Table 2 summarizes key statistics for Bitcoin, covering its history from inception to May 1, 2022. Data was collected hourly using Yahoo Finance, and log returns were computed as r = ln(Pt/Pt-1), where Pt represents the hourly reference rate. This formula effectively captures price dynamics over time and allows for an in-depth analysis of return patterns.

Skewness highlights distribution asymmetry, and kurtosis indicates “tailedness,” reflecting the high probability of extreme events relative to a normal distribution. The kurtosis values, significantly above those typical of normal distributions, underscore the leptokurtic nature of cryptocurrency returns, with frequent large fluctuations that deviate from expected patterns in traditional financial markets.

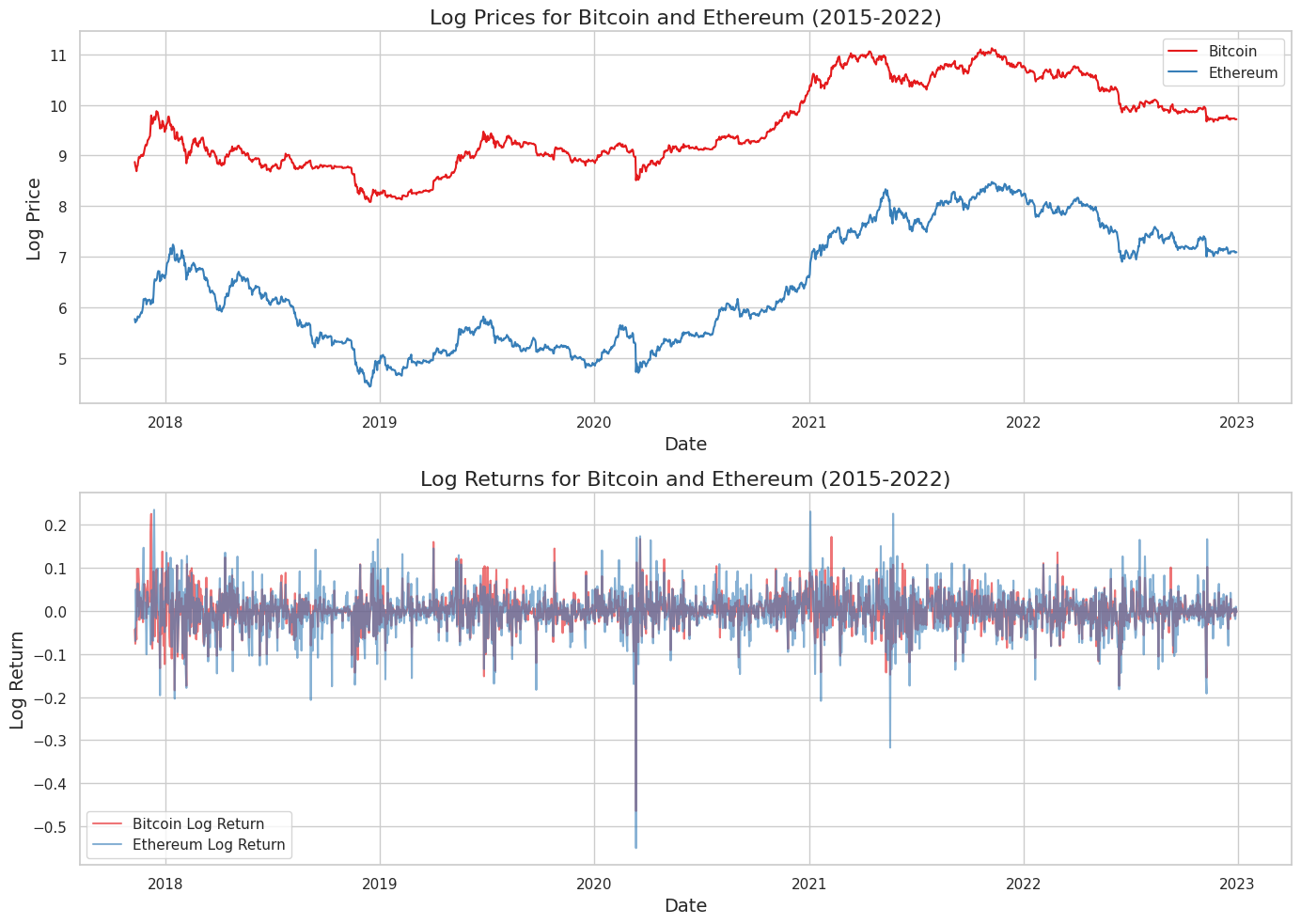

Clustering Analysis and Visualizations

The volatility clustering effect, a key feature in cryptocurrency markets, is evident in Plots above, which show the log prices and log returns for Bitcoin and Ethereum. While log prices illustrate a generally steady growth, the log returns reveal considerable fluctuations, where large returns are often succeeded by additional large returns of either sign. This pattern verifies the presence of volatility clustering in cryptocurrencies.

One notable market event occurred on May 19, 2021, when regulatory news triggered widespread declines in cryptocurrency values. Bitcoin and Ethereum experienced their largest single-day losses in over a year, with the sector's overall market capitalization dropping by nearly $1 trillion. This event underscores the susceptibility of cryptocurrency markets to external shocks and exemplifies how sudden regulatory developments can spike volatility, reinforcing the need for active and continuous market monitoring.

A Comparison with Other Financial Assets

To draw a comprehensive comparison between cryptocurrency returns and those of other financial assets, we analyzed the daily log return distributional parameters for Bitcoin, Ethereum, the S&P 500, Nasdaq, Gold, and the U.S. Dollar Index. Table 3 provides a detailed comparison of daily return statistics across these assets, revealing how cryptocurrency returns align and diverge from traditional financial markets.

Table 3. Daily Return Statistics Comparison

| BTC | ETH | S&P 500 | Nasdaq | GLD | Dollar Index | |

|---|---|---|---|---|---|---|

| Mean | 0.00189 | 0.00130 | 0.00034 | 0.00048 | 0.00015 | 0.00012 |

| Median | 0.00204 | 0.00101 | 0.00060 | 0.00107 | 0.00045 | 0.00010 |

| Maximum | 0.225 | 0.344 | 0.090 | 0.089 | 0.048 | 0.020 |

| Minimum | -0.465 | -0.551 | -0.128 | -0.131 | -0.055 | -0.024 |

| Std. Dev. | 0.046 | 0.063 | 0.012 | 0.014 | 0.009 | 0.004 |

| Skewness | -0.69 | -0.66 | -0.92 | -0.78 | -0.18 | 0.01 |

| Kurtosis | 11.74 | 10.68 | 19.89 | 12.27 | 6.29 | 4.51 |

| Count | 2003 | 1209 | 2003 | 2003 | 2003 | 2003 |

Key Observations

- Correlation with Tech Markets. Cryptocurrency returns, especially for Bitcoin and Ethereum, align more closely with Nasdaq returns than with those of the S&P 500, likely due to overlapping investor bases and the high-risk appetite shared by these assets.

- Gain/Loss Asymmetry. Across all analyzed assets, daily minimum returns tend to be larger (in absolute value) than maximum returns, underscoring the prevalent gain/loss asymmetry. For instance, BTC’s minimum return of -0.465 is more than twice its maximum of 0.225, while the S&P 500 and Nasdaq exhibit only a 40 to 50% larger minimum than their maximum.

- Higher Risk and Return Profiles. Cryptocurrencies exhibit significantly higher risk-return profiles compared to traditional assets, with BTC and ETH standard deviations of 0.046 and 0.063, respectively, versus 0.012 and 0.014 for the S&P 500 and Nasdaq. This higher volatility is a double-edged sword, attracting investors seeking elevated returns but requiring meticulous risk management.

The findings in Table 3 illustrate that cryptocurrency returns exhibit distributional characteristics more akin to high-tech equities, particularly Nasdaq stocks. Bitcoin's mean daily log return stands at 0.00189, with Ethereum at 0.00130, showcasing a more pronounced return potential than traditional assets. Moreover, correlations reveal an increasing alignment between Bitcoin and Nasdaq returns, while its correlation with the Dollar Index remains low, turning notably negative over longer time horizons. This correlation dynamic suggests that while cryptocurrencies are often considered an alternative to fiat currencies, their interaction with equity markets has grown more interconnected, with Bitcoin often regarded as a digital alternative to gold.

Further analyses using Granger causality tests indicate that levels of the VIX (a measure of market volatility) have a predictive effect on cryptocurrency returns, especially in terms of absolute changes. This link between the VIX and cryptocurrencies highlights that despite their distinct characteristics, cryptocurrencies are not immune to broader economic conditions. As a result, investors in cryptocurrency markets may benefit from monitoring macroeconomic indicators as part of a broader risk management strategy.

These insights underscore the nuanced position of cryptocurrencies within the financial ecosystem—offering unique opportunities for return while also necessitating tailored approaches for risk assessment and asset allocation.

Correlation of BTC with other Financial Assets

The analysis of daily return correlations between BTC and various financial assets reveals several critical insights. As illustrated in Table 4, BTC has shown a robust positive correlation with ETH, especially from 2016 onward, peaking at 0.910 in 2020. This strong alignment underscores the interconnectedness of these two prominent cryptocurrencies. In contrast, the correlation of BTC with traditional equity indices such as the S&P 500 and Nasdaq was relatively modest in the early years. However, recent data indicates a notable increase, with correlation values reaching 0.446 and 0.462 in 2021, respectively. This trend suggests a growing integration of cryptocurrencies into traditional equity markets, signaling a shift in investor behavior and market dynamics.

Table 4. Daily Return Correlation with BTC

| Year | ETH | S&P 500 | Nasdaq | GLD | Dollar Index |

|---|---|---|---|---|---|

| 2015 | 0.217 | 0.058 | -0.025 | -0.012 | -0.01 |

| 2016 | 0.762 | -0.013 | 0.015 | 0.056 | 0.004 |

| 2017 | 0.810 | 0.085 | 0.072 | 0.019 | 0.005 |

| 2018 | 0.873 | 0.002 | 0.039 | 0.021 | 0.012 |

| 2019 | 0.746 | 0.078 | 0.091 | 0.073 | 0.005 |

| 2020 | 0.910 | 0.101 | 0.132 | 0.045 | -0.003 |

| 2021 | 0.772 | 0.162 | 0.174 | 0.011 | -0.009 |

| 2022 | 0.865 | 0.123 | 0.199 | 0.018 | 0.001 |

| Total | 0.754 | 0.032 | 0.113 | 0.039 | -0.003 |

On the other hand, the correlations of BTC with Gold (GLD) and the U.S. Dollar Index (DXY) exhibit minimal interaction at daily frequencies, remaining close to zero across most observed years. Nonetheless, as presented in Table 4, BTC's relationship with the Dollar Index reveals a significantly negative correlation at broader time horizons, reaching as low as -0.75 for annual returns. This pronounced inverse correlation bolsters the narrative of BTC serving as a potential hedge against U.S. dollar depreciation over extended periods.

Furthermore, the analysis of low-frequency data reinforces BTC’s capacity to provide diversification benefits to traditional investment portfolios, as its performance tends to respond inversely to the dollar's longer-term trajectory. This dynamic interplay between BTC and other financial assets enhances its appeal as an innovative investment vehicle in today's market landscape.

Autocorrelation Analysis

Volatility Clustering and Gain/Loss Asymmetry

Volatility clustering is a well-documented phenomenon in financial markets where periods of high volatility tend to be followed by further high volatility, and similarly, periods of low volatility are succeeded by additional low volatility. This pattern is particularly evident in cryptocurrency markets for Bitcoin and Ethereum. Another critical aspect of this volatility landscape is gain/loss asymmetry, which refers to the tendency for negative shocks to induce greater future volatility than positive shocks of the same magnitude. This relationship can be explored through the analysis of the autocorrelation structure of returns, shedding light on the dynamic behavior of volatility in these digital assets.

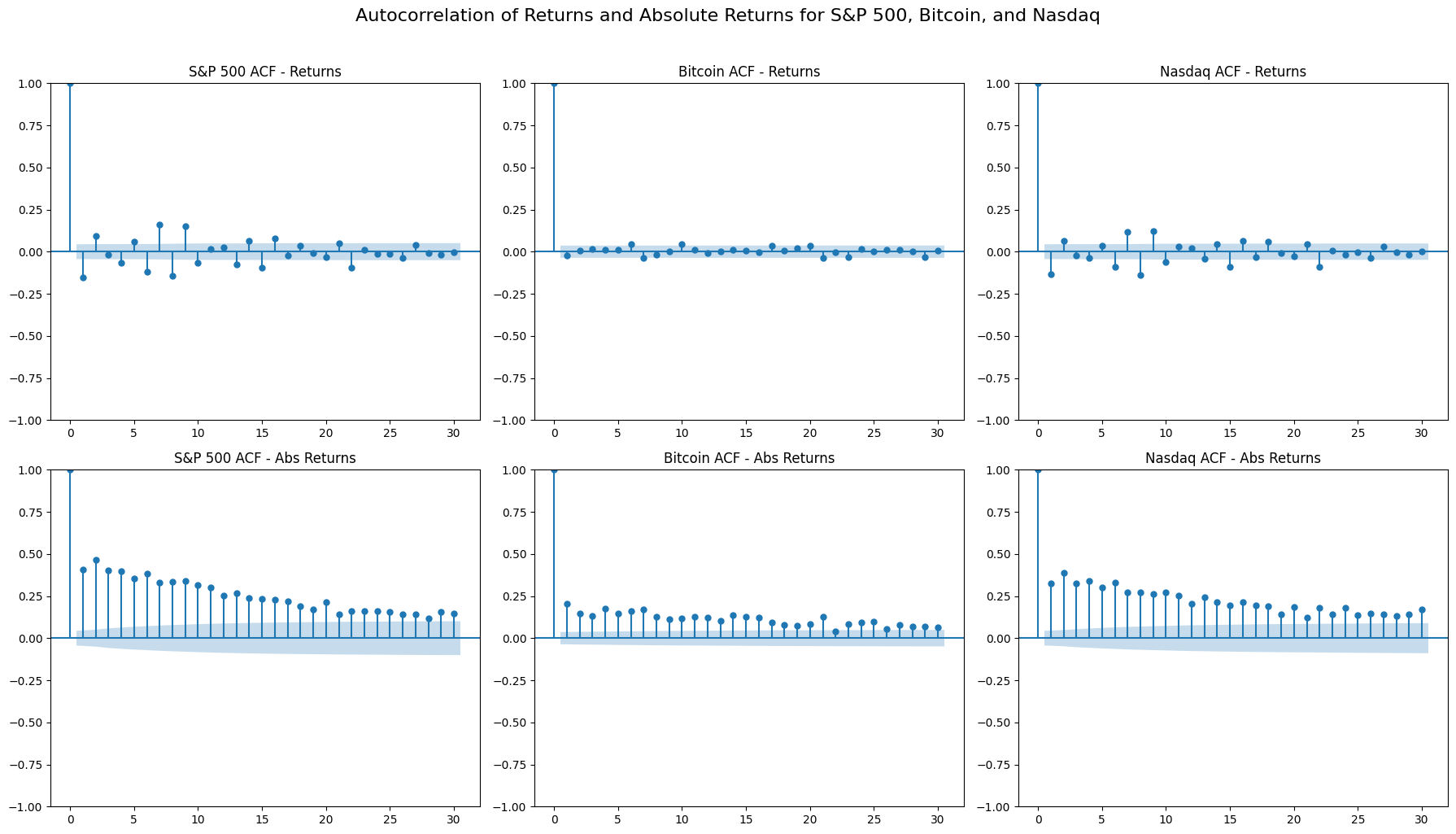

The Autocorrelation Structure of Cryptocurrency Returns

A widely recognized stylized fact in financial returns is that, although returns themselves lack predictability based on historical values, their magnitude—or volatility—exhibits strong predictability over time. This predictable nature of volatility is effectively captured by the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model, a fundamental tool in financial markets for volatility forecasting. To assess the autocorrelation of volatility in cryptocurrencies, we employ the sample autocorrelation function (ACF) for returns, absolute returns, and squared returns. This method provides valuable insights into serial correlations and enables us to examine the memory of volatility inherent in these assets.

The ACF at a lag k is mathematically defined as follows:

ρ(k) = corr(xt, xt-k)

In this equation, ρ(k) measures the serial correlation of the variable x with its own lagged values. Significant values of ρ(k) indicate the potential usefulness of past values for predicting future outcomes, reinforcing the relevance of autocorrelation analysis in understanding market dynamics.

Graphs below present the ACF functions for Bitcoin and Ethereum. We observe significantly stronger autocorrelation in stock markets compared to cryptocurrency markets, with absolute returns showing twice the strength seen in Bitcoin.

Notably, while the ACF for direct returns lacks significance, suggesting unpredictability in immediate returns, the ACFs for absolute and squared returns demonstrate significantly positive correlations up to a lag of 30. This persistence in autocorrelation indicates a long-memory property in cryptocurrency volatility, reminiscent of behaviors observed in traditional equities. Furthermore, it is noteworthy that the ACF values for absolute returns are consistently higher and more persistent than those for squared returns, indicating a stronger and more predictable structure in the absolute returns of BTC

The rapid initial decay of ACF values, followed by a slower and more prolonged decline, implies that the volatility of BTC exhibits mean-reverting characteristics. This observation aligns with models that assume reverting patterns, contrasting sharply with non-mean-reverting, random-walk models, which would typically show a much slower decay in ACF values over time. Consequently, these findings support the application of specialized long-memory volatility models rather than traditional Exponentially Weighted Moving Average (EWMA) or GARCH (1,1) models, which may inadequately capture the intricate volatility dynamics prevalent in cryptocurrency markets. This nuanced understanding enhances the analytical framework necessary for accurately assessing volatility in these emerging financial assets.

Calendar Effect in Cryptocurrency Volatility

In addition to our previous analyses, we investigate the calendar-related effects on volatility within cryptocuOurrrency markets. Unlike traditional equities, which often exhibit a U-shaped volatility curve across trading hours, cryptocurrencies trade continuously across all hours and days. This continuous trading framework allows for unique intraday and interday patterns to emerge, contributing to the distinct volatility dynamics characteristic of this asset class.

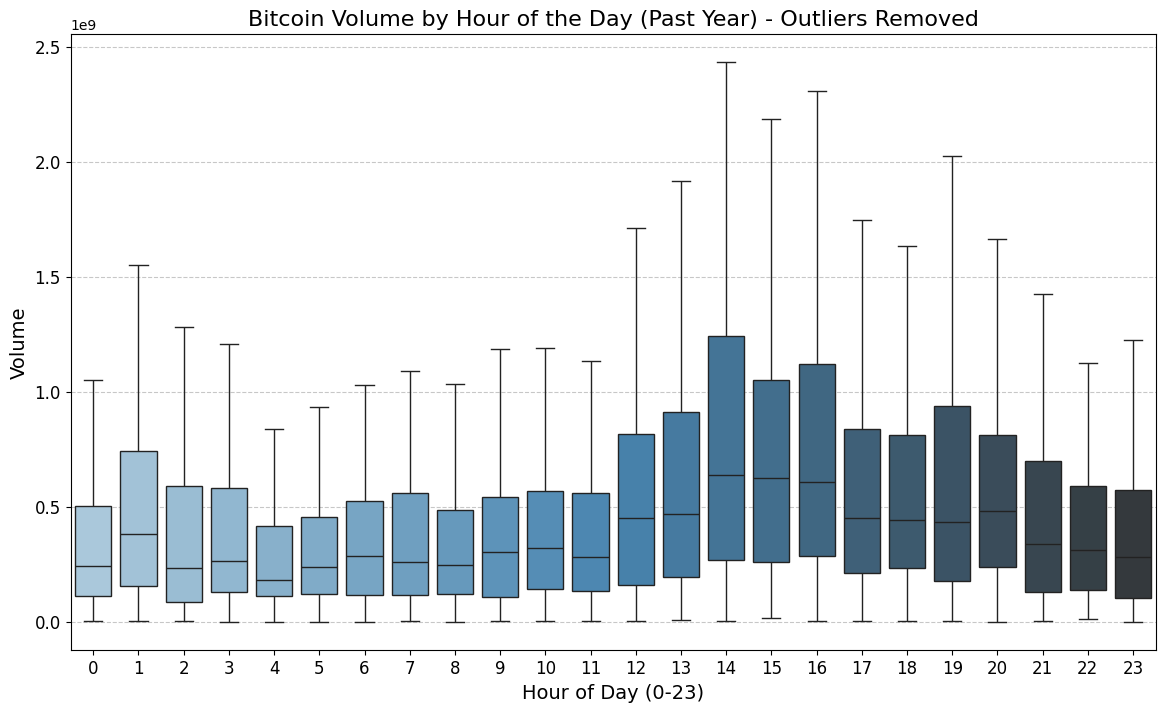

Hour of the Day Effect

Stratified analysis reveals distinct patterns in cryptocurrency returns and volatility across various hours of the day. Specifically, trading hours that coincide with the opening times of major global markets—such as the early morning hours in New York—tend to exhibit significantly higher volatility and trading volumes. This heightened activity likely results from intensified market participation during these periods, where the overlap of global trading leads to an influx of trades that amplify both returns and fluctuations. Statistical tests confirm the robustness of these observations, indicating that certain hours consistently experience elevated average returns and volatility compared to others. This phenomenon is likely driven by increased trading demand as these markets open, underscoring the importance of temporal dynamics in cryptocurrency trading.

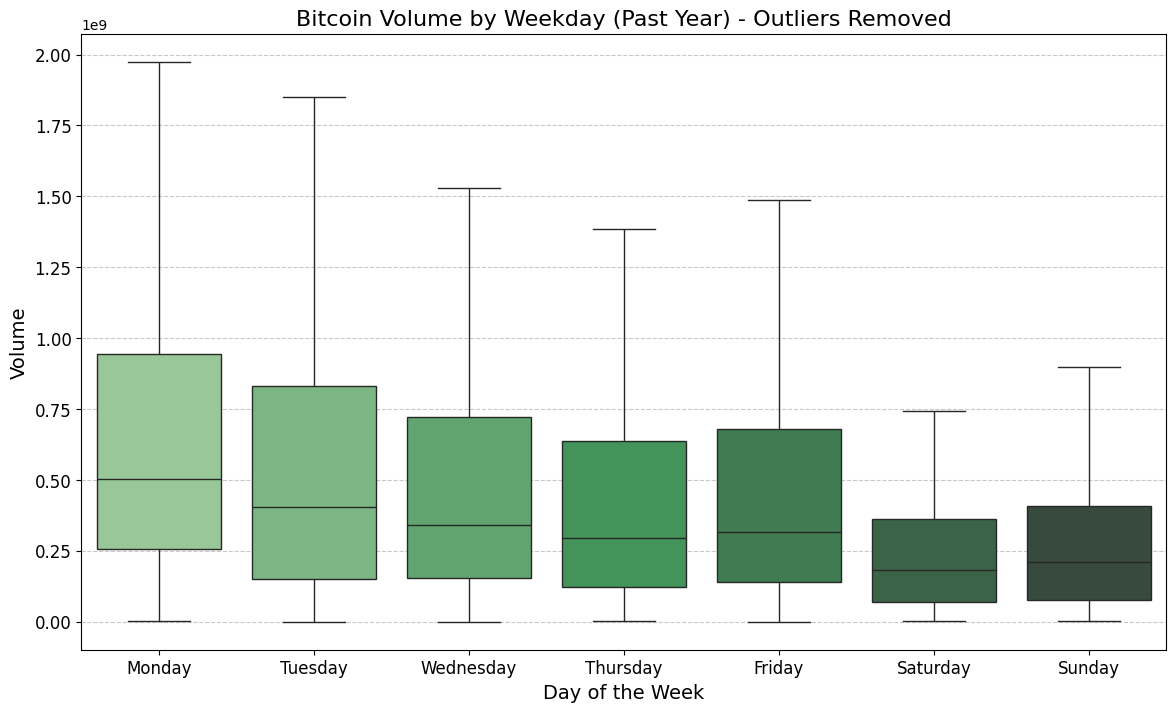

Weekday Effect

Additionally, we observe a notable weekday effect in cryptocurrency markets, where returns and volatility vary throughout the week. The data indicates that both volatility and trading activity are typically lower on weekends, while Fridays exhibit a marked increase in both metrics. This pattern may reflect the influence of institutional trading behaviors and strategic investor positioning, as market activity rises toward the end of the week. Investors may be preparing for the lower-participation weekend periods, contributing to the heightened volatility observed on Fridays. Conversely, the reduced weekend volatility likely stems from decreased market activity, aligning with the notion that lower trading volumes lead to more stable pricing during these days. This weekday effect provides valuable insights for understanding and timing market activity, particularly for traders considering short-term strategies that capitalize on these fluctuations.

Impact of US Holidays

Finally, we delve into the influence of major U.S. holidays on cryptocurrency volatility, given the substantial investor bases in the U.S. As shown in Table 5, Bitcoin and Ethereum exhibit unique volatility patterns surrounding these holidays. During U.S. holiday periods, average absolute returns and their standard deviations tend to decrease, suggesting that lower participation from these key investor groups correlates with dampened market volatility. This finding highlights the critical role of macroeconomic and global calendar effects in influencing cryptocurrency trading behavior, providing valuable insights for developing trading strategies that account for seasonal liquidity and volatility shifts. Understanding these effects can enhance risk management practices and inform decision-making processes for traders operating in the dynamic cryptocurrency market.

Table 5. Calendar Effect on Cryptocurrency Volatility for BTC and ETH

| Day | BTC Count | BTC Mean | BTC Std. Dev | t-test (BTC) | ETH Count | ETH Mean | ETH Std. Dev | t-test (ETH) |

|---|---|---|---|---|---|---|---|---|

| Monday | 7,752 | 0.0050 | 0.0068 | 0.34 | 6,000 | 0.0072 | 0.0092 | 2.11 |

| Tuesday | 8,760 | 0.0051 | 0.0069 | 0.00 | 6,744 | 0.0076 | 0.0097 | 0.00 |

| Wednesday | 8,879 | 0.0052 | 0.0073 | -1.48 | 6,863 | 0.0074 | 0.0090 | 0.83 |

| Thursday | 8,568 | 0.0053 | 0.0077 | -2.23 | 6,696 | 0.0076 | 0.0098 | -0.31 |

| Friday | 8,328 | 0.0055 | 0.0083 | -3.36 | 6,552 | 0.0076 | 0.0104 | -0.06 |

| Saturday | 9,384 | 0.0044 | 0.0062 | 6.60 | 7,296 | 0.0060 | 0.0075 | 10.25 |

| Sunday | 9,384 | 0.0046 | 0.0065 | 4.87 | 7,296 | 0.0063 | 0.0082 | 8.10 |

| US Holidays | 1,392 | 0.0047 | 0.0059 | 2.16 | 1,080 | 0.0068 | 0.0085 | 2.64 |

Conclusion

In conclusion, this article presented a comprehensive analysis of cryptocurrency returns, highlighting both their similarities to and distinct divergences from traditional financial markets. Our examination indicates that while cryptocurrencies exhibit some stylized facts common in financial assets, they also possess distinct characteristics, particularly in terms of volatility patterns and calendar effects. For instance, unlike equities, the volatility behavior of cryptocurrencies, including notable leverage effects, often defies predictability across the analyzed assets, thereby posing challenges to conventional risk management strategies.

Significant volatility is observed during specific intraday and weekly timeframes, alongside unique correlations observed around holidays, underscoring the intricate relationship between trading patterns and external market influences.

Additionally, our findings reveal that cryptocurrencies are characterized by leptokurtic return distributions and pronounced gain/loss asymmetry, as well as a non-trivial relationship with equity indices and the Dollar Index. These insights highlight the necessity of adapting portfolio strategies and risk management approaches specifically for cryptocurrency markets, particularly in light of their unique volatility dynamics.

Understanding these complexities is essential for developing effective trading strategies and robust risk management techniques within the ever-evolving cryptocurrency landscape. Looking forward, future research can focus on refining volatility forecasting models, enhancing our ability to create strategies that accommodate the unique behaviors of the cryptocurrency market. This approach will better equip investors and market participants to navigate the intricacies of this innovative financial domain.