Revolutionizing Financial Decision Making with Adaptive Multi-Agent Frameworks and Large Language Models

3 January, 2025

Financial markets are dynamic, multifaceted systems where a vast array of data—from quantitative metrics and textual narratives to visual indicators—converges to shape decision-making. The integration of these diverse data sources poses a unique challenge, particularly in the context of volatile market conditions and high-stakes applications such as trading and risk management. Traditional approaches, rooted in econometrics and statistical analysis, excel at processing structured numerical data but often falter in synthesizing unstructured inputs like text and images without extensive manual effort.

Recent advancements in Artificial Intelligence, particularly in Large Language Models (LLMs), have revolutionized financial analytics. Models such as FinGPT, BloombergGPT, and FinBERT exemplify how domain-specific adaptations can unlock actionable insights from unstructured financial texts, including news articles, earnings call transcripts, and regulatory filings. These tools extend the capabilities of general-purpose LLMs like GPT by providing specialized frameworks for analyzing financial information.

The real innovation lies in the ability of modern LLMs to integrate multimodal data, combining textual, visual, and historical time-series information into unified predictive frameworks. This evolution addresses a critical gap in traditional financial models, offering enhanced flexibility and predictive power. At the same time, it underscores the need for model explainability, especially in applications where decision-making impacts large-scale investments or market stability.

In this article we explore the transformative role of LLMs in multimodal financial analytics, with a particular focus on innovative frameworks that incorporate multiple data types and facilitate adaptive decision-making. While these models significantly outperform traditional methods in terms of predictive accuracy and risk assessment, this study also examines the persistent challenges—such as ensuring scalability, maintaining transparency, and further enhancing multimodal synthesis—to unlock their full potential.

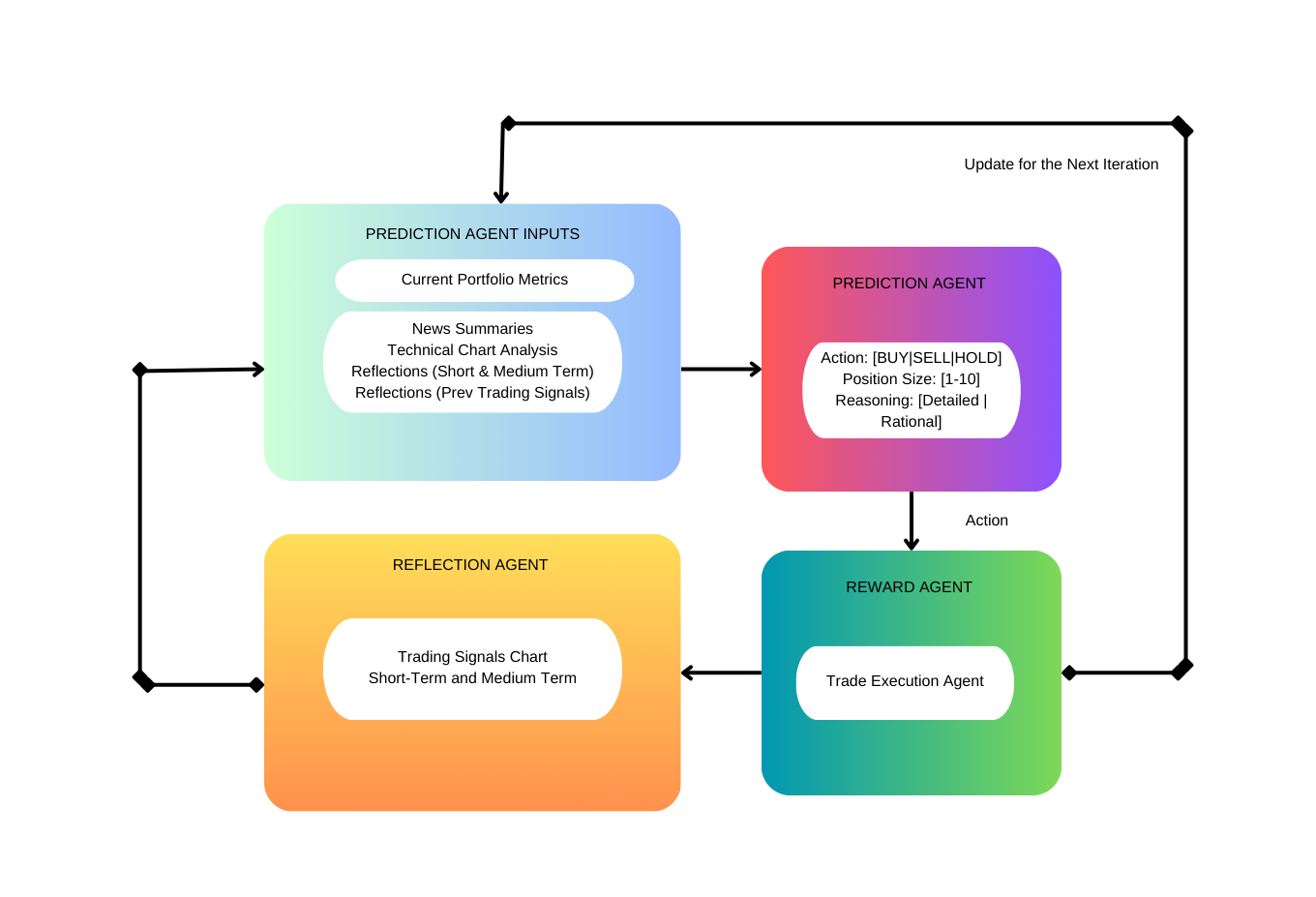

Framework for Multimodal Trading Analytics

In this section, I will describe the operational blueprint of a trading system that harmonizes multimodal financial data—textual, visual, and historical—into actionable insights. By leveraging specialized agents powered by Large Language Models, this framework exemplifies the shift toward advanced, explainable financial AI systems. Notably, a hypothetical scenario such as analyzing Apple Inc.'s stock in light of its quarterly earnings announcement demonstrates how such a system could synthesize financial news, stock charts, and historical trends to craft optimal trading recommendations.

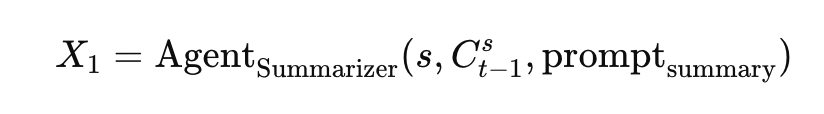

1. Summary Module

The Summary Module synthesizes critical information from textual data, specifically summarizing relevant financial news for a given stock ticker. By utilizing a language model agent, the module generates concise summaries of key events and facts from the previous day’s news. The process involves prompting the agent with a specific stock ticker s and relevant corpora Ct−1s:

Here, X1 represents the generated summary, which distills complex narratives into actionable insights for financial analysis. For example, the module might analyze tech news covering semiconductor trends that could impact NVIDIA’s stock, translating diverse narratives into summarized insights for analysts and traders.

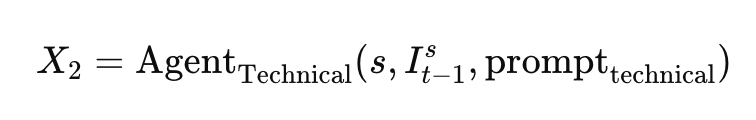

2. Technical Analyst Module

The Technical Analyst Module extracts insights from historical market data visualized as candlestick charts and technical indicators. Using the vision capabilities of the language model agent, it interprets these visual inputs to identify patterns, trends, and signals relevant to stock performance. The process can be summarized as:

Here, It−1s represents the visual data, including historical charts over a 60-day period, while X2 encapsulates the generated technical analysis. By analyzing these visuals, the module evaluates critical formations like head-and-shoulders patterns or key support and resistance levels, delivering precise and nuanced evaluations of market conditions.

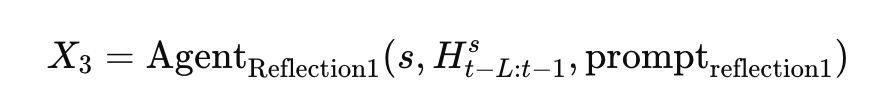

3. Reflection Module

The Reflection Module analyzes historical trading signals and performance to derive insights into the effectiveness of past strategies. The module operates in two stages:

Short-Term Performance Analysis: This part evaluates historical trading data Ht−L:t−1s for the past L days, generating short- and medium-term reflections:

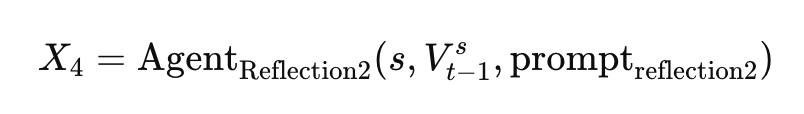

Visual Representation Analysis: The second stage involves analyzing visual representations Vt−1s of trading signals from the previous 30 days to derive additional insights:

For instance, analyzing Tesla’s trading signal patterns during its recent stock split might reveal key trends influencing its price fluctuations. The insights generated help ensure robust predictive analytics by considering past performance comprehensively.

4. Final Decision Module

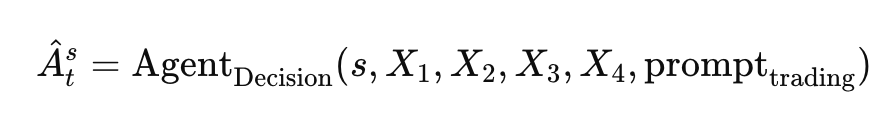

The Final Decision Module integrates outputs from the Summary, Technical Analyst, and Reflection modules to generate actionable trading recommendations. This module employs advanced reasoning to synthesize inputs into a coherent decision:

The output (Ast) consists of three components:

- Action Recommendation: Buy, sell, or hold decisions.

- Position Size: Suggested trade volume.

- Rationale: A detailed explanation for the decision.

This approach ensures decisions are founded on comprehensive multimodal analysis. A practical use case might involve leveraging the system to recommend holding Microsoft stock during a high-impact earnings period, balancing insights from its latest reports, technical indicators, and past performance reflections.

Implementation Insights

The framework employs a modular multi-agent architecture implemented using the LangGraph library, with each node corresponding to a specialized agent. Key details include:

- Directed Graph Design.

- Dependencies are managed via the StateGraph class, enabling seamless integration across agents. This facilitates scenario-specific workflows, such as bypassing technical analysis for stocks with sparse historical data.

- Model Selection.

- Most agents use GPT-4o-mini, a multimodal model fine-tuned for structured outputs, with a temperature setting of 0.3 for stability.

- The Prediction Agent utilizes o1-mini, designed for advanced reasoning tasks, enabling robust decision-making under uncertainty.

- Vision Capabilities.

- Modules like the Technical Analyst and parts of the Reflection Module leverage advanced vision systems to analyze intricate market charts, such as dual-moving-average crossovers or RSI divergences, to decode market sentiments visually.

- Real-Time Scalability.

- The system’s modularity supports real-time analyses for large-scale portfolios, adapting dynamically to shifts in data availability or market volatility.

A noteworthy application could include its use by hedge funds for intraday trading of volatile assets like cryptocurrencies, where swift, adaptive, and multimodal insights can make a decisive difference.

This flexible and state-of-the-art system exemplifies how AI advancements enable more granular and actionable financial analytics.

Experiments

To validate the proposed multi-agent trading framework, we conducted comprehensive experiments benchmarking it against conventional trading systems. By focusing on three technology giants—Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT)—the study demonstrates the system's versatility in handling diverse financial conditions and its potential to outperform baseline models.

Data Collection

The study examined nine months of market activity from April 1, 2023, to December 29, 2023, using a combination of textual, visual, and quantitative data sources. This period was structured into a two-month training phase (April 1 to May 31) and a seven-month testing phase (June 1 to December 29). By systematically integrating daily news articles from Yahoo Finance, candlestick charts, and reflection data derived from prior trading signals, the dataset offered a rich, multimodal foundation for evaluation.

In particular, the technical analysis incorporated robust financial indicators, including:

- Simple Moving Averages (10- and 50-day): Used to identify trend directions.

- Relative Strength Index (14-day period): Evaluated market momentum to detect overbought or oversold conditions.

- Bollinger Bands (20-day period, 2 standard deviations): Measured market volatility.

- Moving Average Convergence Divergence (MACD): Assessed momentum and trend changes.

- Trading Volume: Provided insights into the strength of price movements.

Reflection data involved a combination of trading signal imagery and performance metrics from historical activities, enhancing the agents' ability to analyze past outcomes for predictive decision-making. During the training phase, these comprehensive datasets allowed the system to build a robust foundation of historical and contextual knowledge, ultimately facilitating accurate testing-phase evaluations.

Table 1 below summarizes the dataset statistics, detailing the distribution of trading days, news articles, and technical indicators across the analyzed assets:

| Ticker | Period | Trading Days | News Articles |

|---|---|---|---|

| AAPL | Training (Apr 1 - May 31) | 42 | 1,081 |

| Testing (Jun 1 - Dec 29) | 145 | 4,886 | |

| AMZN | Training (Apr 1 - May 31) | 42 | 1,113 |

| Testing (Jun 1 - Dec 29) | 145 | 5,556 | |

| MSFT | Training (Apr 1 - May 31) | 42 | 1,897 |

| Testing (Jun 1 - Dec 29) | 145 | 1,249 |

This dataset offers an extensive resource for testing the multimodal trading system, effectively combining historical, technical, and textual data into a cohesive experimental framework.

Evaluation Metrics

We employed industry-standard performance metrics to assess the effectiveness of the multi-agent system compared to traditional baselines:

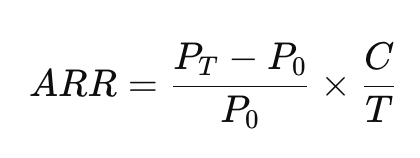

Annual Rate of Return (ARR): This measures the portfolio's growth over the year, providing a fundamental benchmark of financial success. Defined mathematically:

where P0 and PT are initial and final portfolio values, T is the total number of trading days, and C represents the annualized number of trading days.

where P0 and PT are initial and final portfolio values, T is the total number of trading days, and C represents the annualized number of trading days.

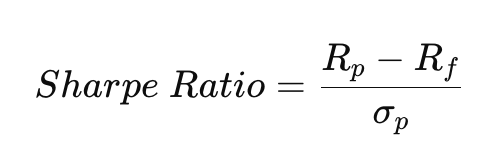

Sharpe Ratio (SR): Evaluates risk-adjusted returns, allowing investors to gauge returns relative to portfolio volatility:

Here, Rp and Rf represent portfolio and risk-free rates of return, while σp indicates portfolio volatility.

Here, Rp and Rf represent portfolio and risk-free rates of return, while σp indicates portfolio volatility.

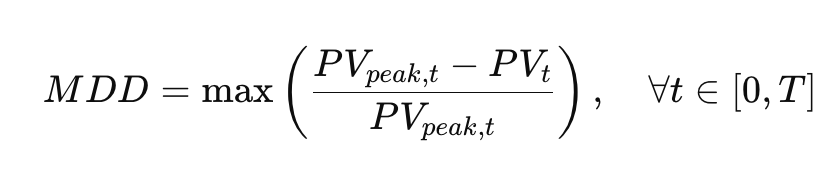

Maximum Drawdown (MDD): Measures the largest peak-to-trough decline within the study period, capturing downside risk exposure:

This metric provides insight into the portfolio's resilience during adverse market conditions, making it highly relevant in risk-aware investment strategies.

This metric provides insight into the portfolio's resilience during adverse market conditions, making it highly relevant in risk-aware investment strategies.

By aligning these metrics with the system’s multimodal capabilities, our evaluation highlights not only returns but also risk management and stability in dynamic financial environments.

Benchmark Models

To evaluate the robustness and efficiency of our multi-agent trading framework, we conducted comparative analyses against established traditional and algorithmic trading strategies. This benchmarking ensures a comprehensive understanding of the framework’s relative performance across diverse market scenarios.

Traditional Strategies

We implemented three widely-used traditional trading approaches:

- Buy-and-Hold (B&H): A passive investment strategy that holds a position over the long term, disregarding short-term price fluctuations. This approach serves as a baseline for assessing overall market trends.

- Moving Average Convergence Divergence (MACD): A trend-following momentum indicator used to generate buy and sell signals based on moving averages of varying timeframes.

- KDJ with RSI Filter: A combined oscillator-based strategy that refines trading signals by filtering them through the Relative Strength Index (RSI), offering nuanced decision-making in volatile markets.

LLM-based Benchmark

We further compared our framework to FinAgent, a state-of-the-art multi-modal trading agent enhanced with tool augmentation. FinAgent employs reinforcement learning on extensive financial datasets and represents a cutting-edge competitor in the realm of automated trading systems.

Main Results

Our multi-agent framework demonstrated robust performance across the three major technology stocks—Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN)—highlighting its adaptability and efficacy. Table 2 summarizes key performance metrics.

Comparative Performance

The FinVision framework outperformed traditional buy-and-hold strategies on several fronts, particularly in terms of Annual Rate of Return (ARR) and Sharpe Ratio:

- Apple (AAPL): Achieved an ARR of 14.79% with a Sharpe Ratio of 1.20, surpassing the market’s ARR of 13.56% and Sharpe Ratio of 0.67.

- Microsoft (MSFT): Recorded a remarkable ARR of 25.57% and Sharpe Ratio of 1.41, outperforming the market’s ARR of 22.27% and Sharpe Ratio of 1.01.

- Amazon (AMZN): While slightly trailing the market’s ARR of 43.57% with a 42.14% ARR, the framework excelled in risk-adjusted returns, achieving a Sharpe Ratio of 1.72 compared to the market’s 1.37. Additionally, it minimized the Maximum Drawdown to 12.09% versus 17.45% for the market.

These results demonstrate the framework's ability to achieve competitive returns while delivering superior risk management, showcasing its viability as a sophisticated alternative to passive strategies.

Performance in Bullish Markets

The test period was characterized by a strongly bullish market, favoring traditional buy-and-hold strategies, as reflected in AMZN's ARR of 43.57%. Despite this, the FinVision framework's ability to deliver comparable returns while enhancing risk-adjusted metrics is noteworthy. By reducing maximum drawdowns and maintaining high Sharpe Ratios, the framework highlights its value in balancing return optimization with robust risk control, even in trending markets.

Impact of Reflection Mechanism

A key differentiator of the FinVision framework is its reflection mechanism, which adapts trading decisions based on historical performance and market conditions. Ablation studies validated this feature, showing significant performance improvements when reflection was enabled. Across all analyzed stocks, the reflection component substantially enhanced key metrics, reaffirming its role as a critical adaptive learning tool.

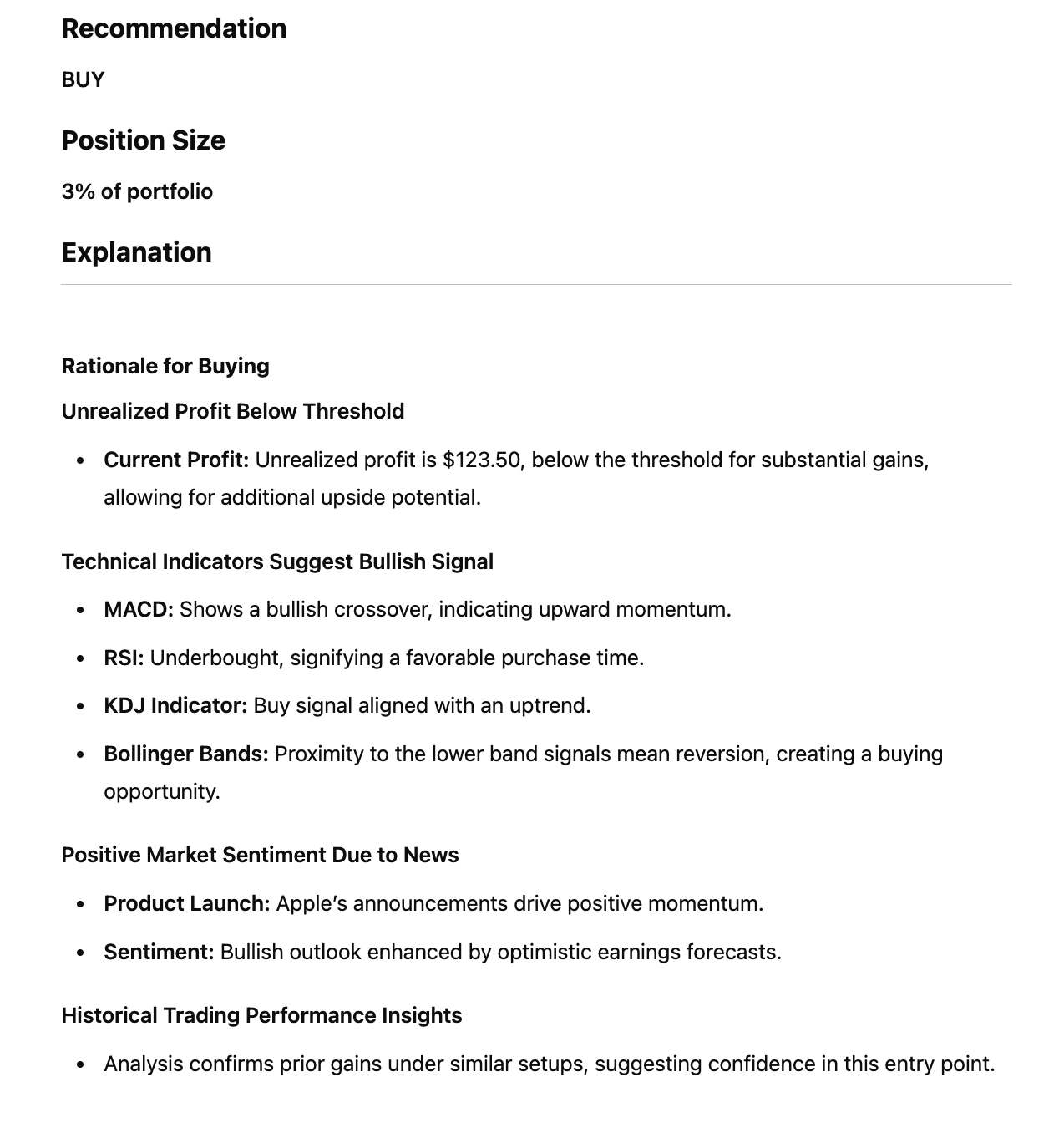

Case Study: Apple (December 19, 2023)

To illustrate the framework’s explainability, consider its trading decision for AAPL on December 19, 2023. Technical indicators suggested a bullish trend, prompting the prediction agent to incorporate news signals and historical reflections. The agent recommended a long position, resulting in a successful trade as the stock price peaked that day.

This dynamic integration of diverse data sources demonstrates the system’s nuanced decision-making capability. Furthermore, the framework’s position-sizing recommendations—detailing precise portfolio percentages—offer an additional layer of risk management. For example, suggesting a 15% portfolio allocation for the trade allowed for optimal risk exposure, aligning with the trader's risk tolerance.

Insights into Explainable AI

The explainable nature of FinVision’s decision-making process enables traders and analysts to understand and trust its outputs. By transparently showcasing its reasoning and adjustment mechanisms, the framework facilitates continual optimization and supports risk-aware trading in complex market conditions. This combination of adaptability, transparency, and precision highlights its potential as a groundbreaking tool in the evolving field of algorithmic trading.

Discussion

The results of this study underscore the transformative potential of integrating Large Language Models (LLMs) with multi-agent systems in the realm of financial analytics. These findings illustrate that LLM-based frameworks can bring a paradigm shift in predictive trading strategies, portfolio optimization, and risk assessment. However, as with any emerging technology, challenges persist, particularly regarding the fine-tuning of these models to optimize for efficiency, interpretability, and the diverse nature of financial data.

Despite these challenges, our proposed system offers significant real-world applications—particularly in portfolio optimization, where it can aid in adjusting to market fluctuations, and in risk management, where its adaptive learning mechanism shines. The framework’s ability to provide transparent decision-making traces meets the increasing demand for explainability and accountability in AI-driven finance. Future research avenues could focus on incorporating real-time financial data feeds and expanding the framework’s scope to include additional asset classes, such as commodities or currencies, and macroeconomic indicators that can provide deeper insights into market dynamics.

Conclusion

The exploration of LLM-based multimodal systems in financial decision-making has shown remarkable potential, marking an important shift in how we approach financial analytics. Our study affirms that these systems can outperform traditional methodologies, offering more adaptable and efficient trading strategies, despite certain areas still requiring enhancement. The future of financial markets lies in continuously refining these models, particularly through incorporating real-time data streams and improving explainability to ensure broader adoption and confidence among industry stakeholders.

For financial professionals, the practical applications of multimodal systems are clear: they provide the flexibility to craft more adaptive trading strategies, enhance risk management practices, and leverage diverse datasets for more informed decision-making. This research exemplifies the paradigm shift toward AI-powered analytics, offering a forward-looking approach to more intelligent and dynamic financial management.