Strategic Optimization of Parameters in Quantitative Trading

20 November, 2023

Finding the perfect settings is key to success with quantitative trading strategies. Traders can boost profits by fine-tuning their strategies to get the best results from small adjustments.

Optimisation involves finding the ideal parameters for a trading strategy to maximise profits. A core part of the process involves exploring different settings that shape algorithm behavior. Known as parameters, these inputs are tweaked to find profitable combinations.

Optimisation Process Step by Step

The goal is to data-mine the "golden" configurations that offer the best chance of profitability going forward, based on past performance. The following steps outline a clear process for effectively exploring a strategy's parameter landscape to improve its odds of repeated success over time.

- Step 1: Define Core Signals

Set entry and exit rules based on indicators

e.g. Buy on SMA crossover, Sell on RSI overbought

- Step 2: Select Parameter Types

Common areas to refine include:

Indicator periods (SMA fast/slow lines, RSI)

Levels (RSI overbought/oversold bands)

Filters (Min/max daily movement)

- Step 3: Specify Parameter Ranges

Define search spaces for each type

SMA fast: 5-25 days

SMA slow: 15-50 days

RSI period: 10-30

RSI overbought: 60-80

RSI oversold: 20-40

- Step 4: Run Backtest Iterations

Grid test all parameter permutations

Evaluate fitness metrics like profit%, drawdown

- Step 5: Identify Best Combination

Highest returning setups show optimal settings

Fast SMA 15 days, slow 35, RSI 21, 70/30 bands

- Step 6: Forward Test Strategy

Validate optimized parameters on fresh market sections

Refine further for changing conditions over time

Defining Signals

Strategic optimization is key to developing profitable trading algorithms. The process involves finding the ideal indicator parameters through systematic backtesting. Traders first define signals, like a crossover of fast and slow moving averages combined with an RSI oscillator. Parameters like periods and thresholds are then assigned search ranges.

Backtesting for Optimization

Backtesting software evaluates thousands of combinations on historical data. It identifies the set that generated the highest returns or Sharpe ratio. This grid search optimization technique data-mines "best" values.

Golden Combination of Parameters

For example, an algorithm may test fast SMA periods from 5-25 days, slow from 15-50 days, and RSI periods 10-30 with overbought at 60-80 and oversold at 19-40. By exploring numerous options, traders can determine the "golden combination" before deploying capital live. Of course, past gains don't guarantee future profits - ongoing refinement is still vital.

Grid Search

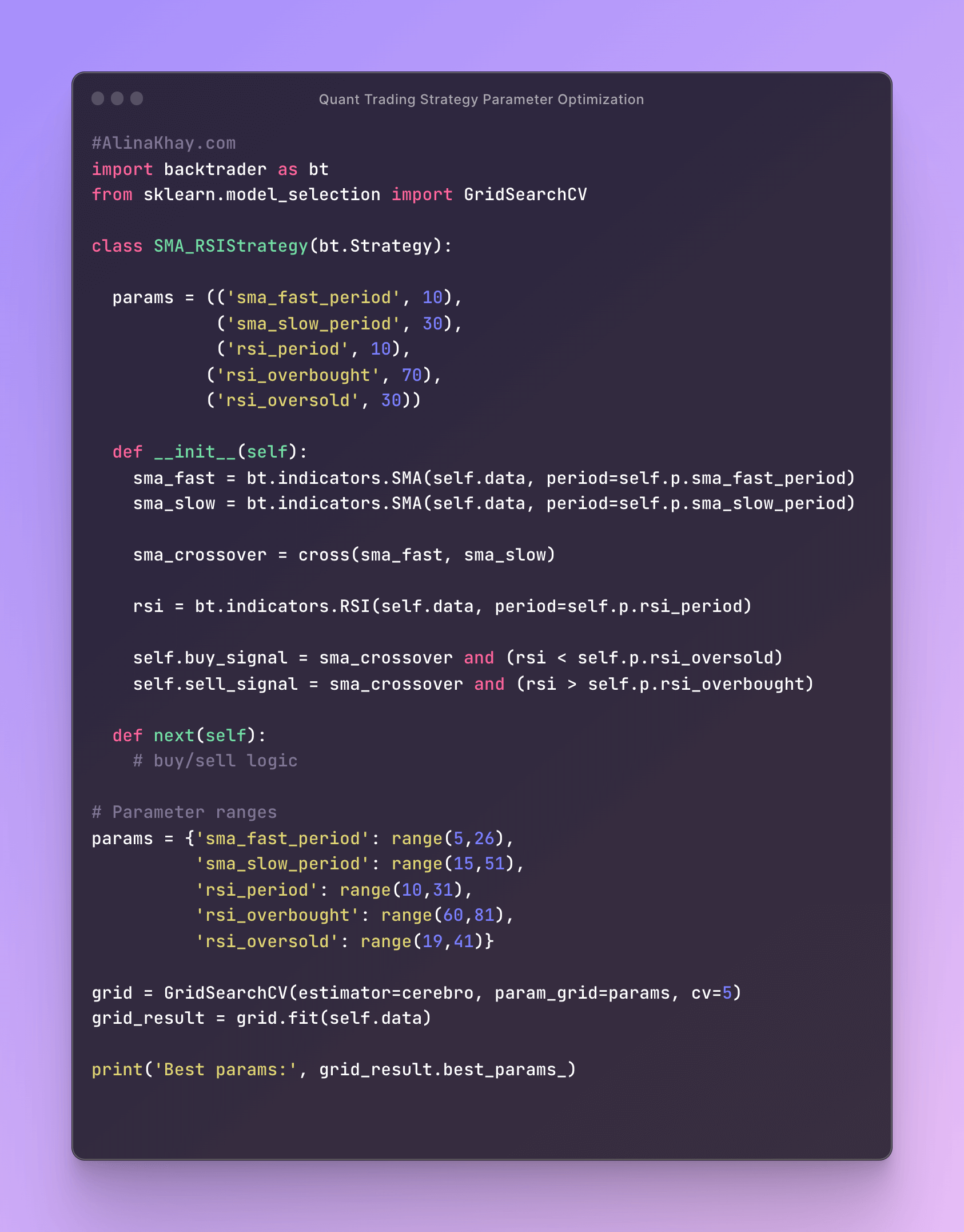

Grid search is a straightforward optimization technique where the parameter space is discretized into a grid. The algorithm systematically tests every combination of parameter values within this grid and evaluates the objective function for each combination. Here is a code example that optimizes both RSI and moving average parameters:

Backtesting thousands of different parameter mixes on historical data reveals the most lucrative potential setups. This grid testing beats wild guessing by methodically exploring the full choice landscape.

Assume Future Matches Past

Optimisation assumes that the future will behave like the past. So optimal parameters based on backtesting should work going forward.

Other important parameters that can be optimized

In the context of optimization algorithms for trading, parameters refer to the various settings and inputs that can be adjusted or fine-tuned within a trading strategy or algorithm. These parameters play a crucial role in determining how the trading algorithm behaves and performs. Here are some common examples of parameters in this context:

1. Position Size: This parameter defines the size or quantity of a financial instrument (e.g., shares of stock, contracts, lots) that the algorithm buys or sells for each trade. Adjusting the position size can impact both potential returns and risk.

2. Stop-Loss and Take-Profit Levels: These parameters define price levels at which the algorithm automatically exits a trade to limit losses (stop-loss) or lock in profits (take-profit).

3. Time Frames: Some trading algorithms use multiple time frames for analysis (e.g., daily, hourly, minute-by-minute). Parameters related to time frames determine which time intervals the algorithm considers for decision-making.

4. Moving Averages: In technical analysis, moving averages are widely used. Parameters related to moving averages include the type of moving average (e.g., simple, exponential) and the time periods used for calculations.

5. Volatility Bands: Parameters like the standard deviation or percentage bands around a moving average can be adjusted to define trading signals based on volatility.

6. Entry and Exit Rules: Parameters defining the specific conditions for entering and exiting trades. For example, a trading algorithm might use parameters related to technical indicators (e.g., RSI, MACD) or fundamental factors.

7. Lookback Periods: Parameters that define the historical data period used for analysis and decision-making. Longer or shorter lookback periods can have a significant impact on trading strategies.

These parameters are just a subset of the many settings that can be found in trading algorithms. The selection and tuning of these parameters are essential steps in optimizing a trading strategy to achieve specific trading goals while managing risk. Traders and algorithm developers often conduct extensive backtesting and sensitivity analysis to determine the most suitable parameter values for their strategies.

Gaining an Edge in Quantitative Trading

It's crucial work that gives quant traders an advantage. By detangling which timeframes and signals work best, strategies stand a far better chance of repeating past profits going forward. Fine-tuning equips algorithms to identify rewarding patterns in live markets too.

Taking time to methodically experiment with key parameter values unlocks powerful strategy optimization. It's a core part of the recipe for building quant systems that reliably outperform over the long-run.

In summary, taking a strategic parameter optimization approach through backtesting can give traders an edge by identifying high-probability set-ups from experience, not guesswork. It's a key process to build profitable quantitative strategies.