A Practical High-Return Alternative to Passive Portfolio Investing

Small adjustments beat heroic predictions.

Momentum has always been the market’s open secret — measurable, persistent, and backed by decades of empirical research. Yet for most investors, capturing it was impractical. Traditional momentum required frequent trading, dozens or hundreds of holdings, and enough turnover to erode the very premium it aimed to harvest.

A simpler form has been hiding in plain sight.

It keeps the core engine — the structural persistence of price trends — but removes the friction. With low-cost single-country ETFs, minimal turnover, and only few trading days per year, the Global Momentum Rotation Strategy (GMRS) delivers the same underlying edge in a form a modern investor can actually implement.

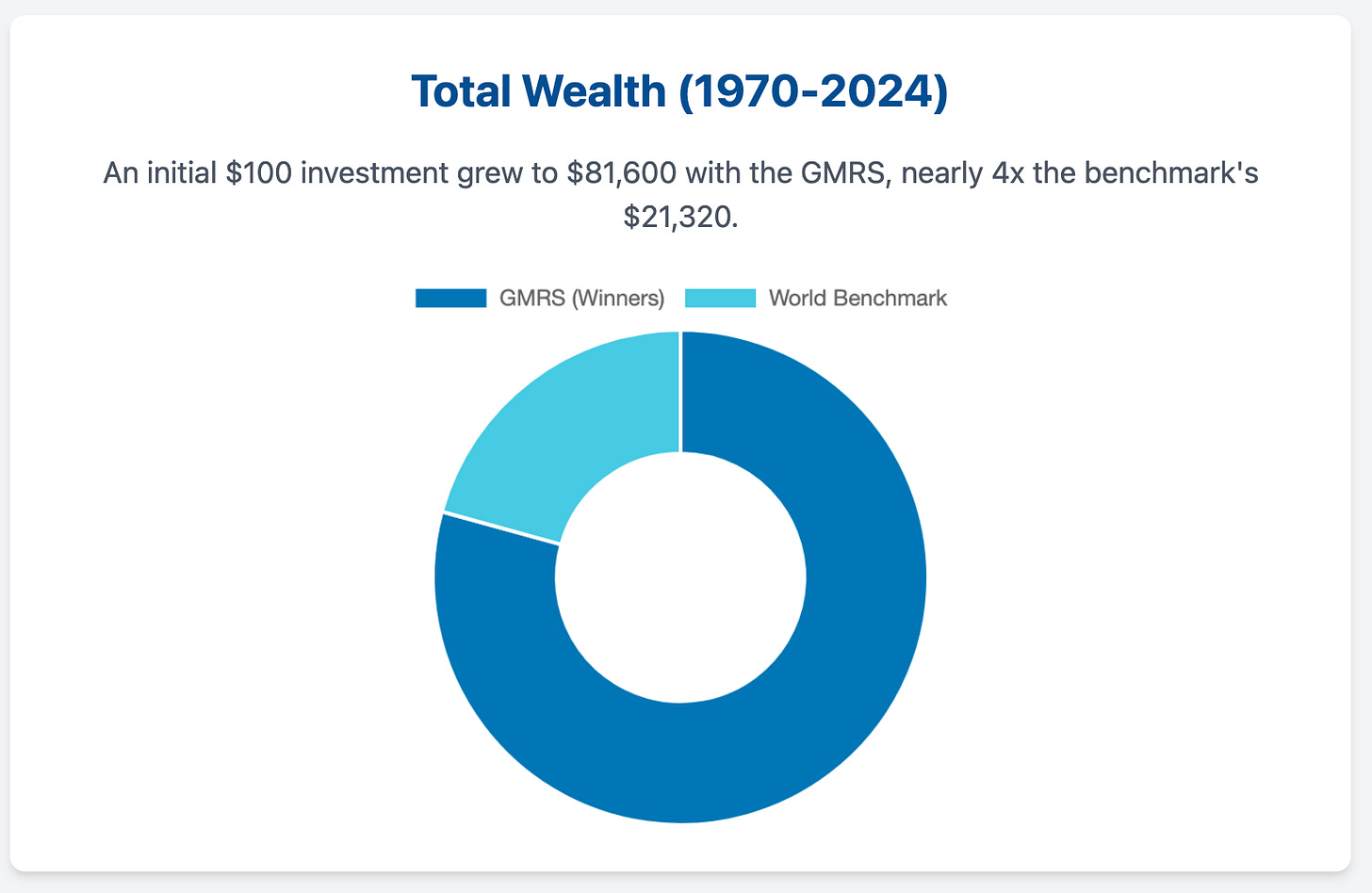

From June 1970 through December 2024, GMRS compounded at 13.09% annually, well ahead of the MSCI World’s. That 275-basis-point gap over MSCI may sound modest, but compounding makes it massive:

$100 → $81,600 using GMRS

$100 → $21,320 in the global benchmark

One small structural choice created a four-to-one wealth difference.

This is what a persistent edge looks like — quiet, repeatable, and hiding behind ordinary rules.