Benoit Mandelbrot's Fractal Insights on Navigating Financial Market Turbulence

Known for his broad interests in practical sciences, Mandelbrot's work, provides a revolutionary perspective on financial systems.

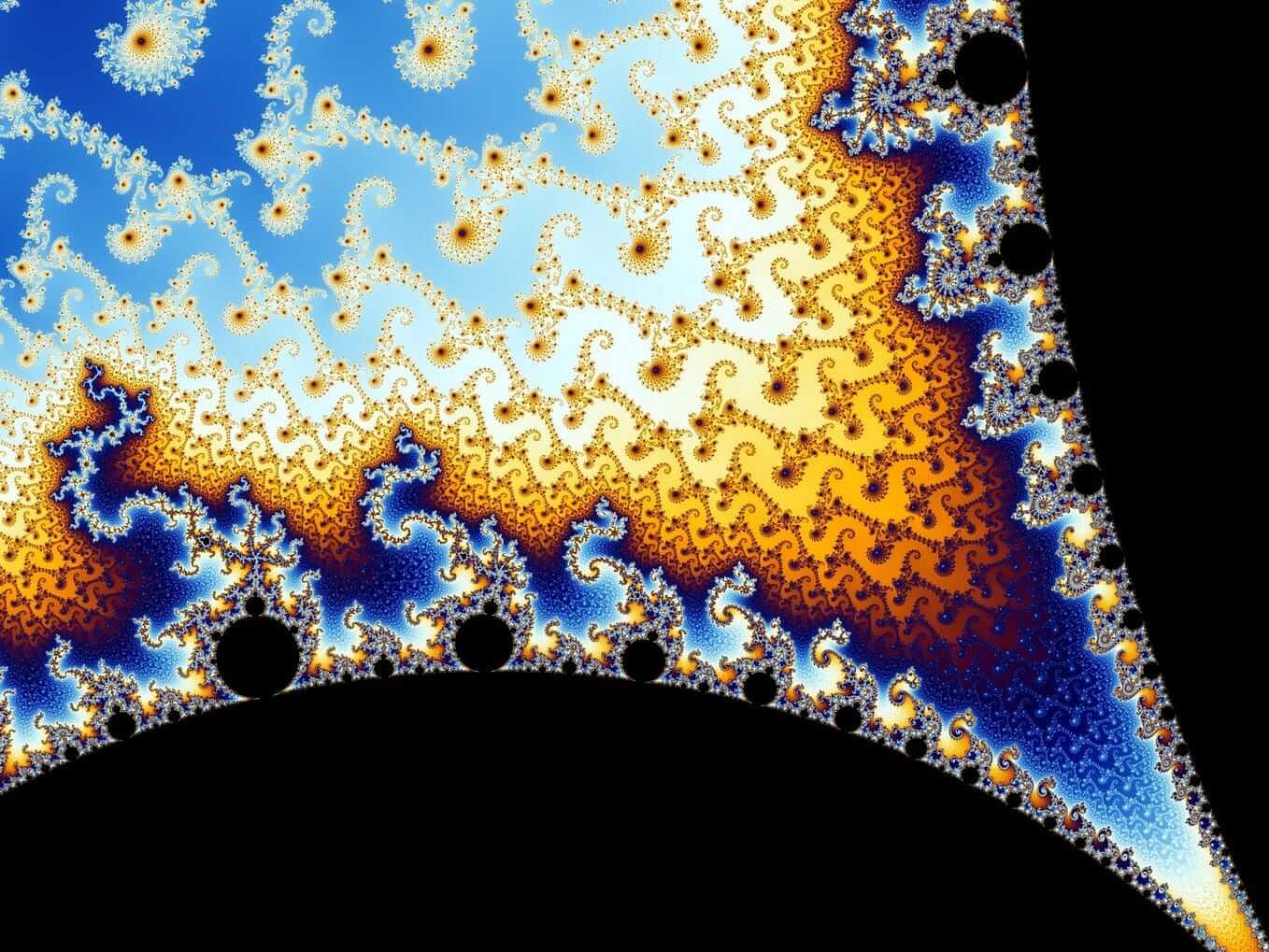

Benoit Mandelbrot, a Polish-born, French, and American mathematician, profoundly impacted our understanding of markets and investing. Known for his broad interests in practical sciences, Mandelbrot's work, alongside Richard Hudson, in "The Misbehavior of Markets: A Fractal View of Financial Turbulence," provides a revolutionary perspective on financial systems. This article aims to distill Mandelbrot’s ideas into accessible insights for non-experts, highlighting the practical implications of his theories on modern investing and financial policy. Mandelbrot's ideas, while complex, offer a valuable lens through which we can better understand the inherent turbulence in financial markets.

The Nature of Market Randomness

Wild vs. Mild Randomness

Mandelbrot categorizes market randomness into three distinct types: wild, mild, and slow. He uses analogies to describe these types:

Wild randomness: Comparable to the gaseous phase of matter, it is characterized by high energy, lack of structure, and …