Beyond Algorithms: The Market Power of Herd Behavior

When Market Psychology Trumps Quantitative Models

You’ve seen it before. A stock plunges 15% on a bad headline, and suddenly the whole sector trades lower. Treasury yields spike, and equities crumble as if every portfolio manager got the same text message. Bitcoin surges, and altcoins blindly follow like ducklings in a row.

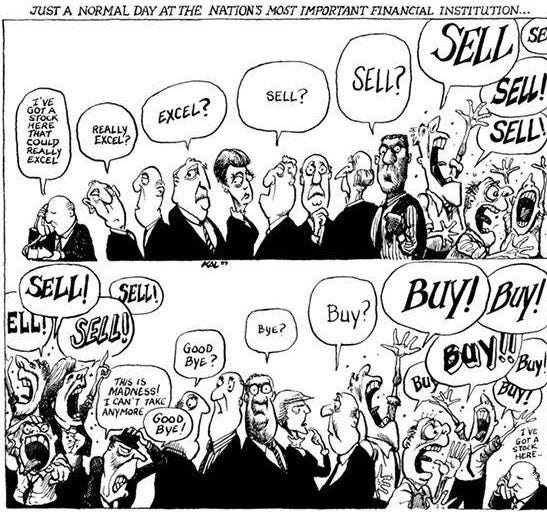

This is herd behavior.

Markets are ecosystems of funds, traders, and algorithms that often move together — not because the fundamentals changed, but because no one wants to be the odd one out when the stampede starts. Herding distorts prices, reshapes correlations, and, if you know how to measure it, offers a way to trade smarter.

Picture a crowded crosswalk. The light is still red, but one impatient pedestrian steps into the street. Within seconds, others follow, not because they checked the traffic themselves, but because someone else moved first. Before long, an entire group is crossing against the signal.

Markets behave the same way. Each investor has private information, but the sight of others buying or selling can outweigh their own analysis. The result is collective motion: traders pile into rallies, dump assets during downturns, and ignore their own signals in favor of the crowd. That’s the herd effect — the quiet force that turns local moves into global waves, and small jitters into full-blown manias or crashes.

Put simply: when the herd is running, dispersion shrinks, and assets move in sync beyond what fundamentals justify.