Bitcoin, Game Theory, and the Financial Chessboard. A Strategic Play for Global Wealth Dominance

Bitcoin, the world’s first decentralized currency, embodies this very principle. Its survival and growth are dictated by strategic decisions millions of participants.

The Game We All Play

Every decision we make is a strategic move in an ongoing game governed by incentives, risks, and expectations. Whether negotiating a salary, investing in markets, or deciding whether to trust a stranger, we constantly assess potential reactions and adjust our choices accordingly. This dynamic of anticipation and response is the essence of game theory—the mathematical framework that explains how rational players make strategic decisions to maximize their outcomes.

Bitcoin, the world’s first decentralized digital currency, embodies this very principle. Its survival and growth are not dictated by a central authority but rather by the strategic decisions of millions of participants—miners, investors, developers, and institutions—each seeking to optimize their own interests. This decentralized coordination is both the challenge and the strength of the Bitcoin network.

The application of game theory to Bitcoin is particularly valuable because it offers a structured way to model and predict the behaviors of various stakeholders in this evolving ecosystem. By analyzing the strategic interactions between participants, we can better understand network stability, adoption patterns, and potential risks. Every aspect of Bitcoin—from mining incentives to network security and market speculation—functions as a complex, interdependent game where trust, incentives, and rational decision-making shape the outcome.

The Fundamentals of Game Theory

Game theory is the study of strategic decision-making in competitive and cooperative environments. It is widely applied across disciplines—from economics and finance to political science, psychology, and even artificial intelligence. At its core, game theory analyzes how individuals or entities make choices when their payoffs depend on the decisions of others.

In the context of Bitcoin, game theory is a powerful tool for evaluating the strategic interactions among its participants. For instance:

Miners face decisions on whether to continue mining honestly or attempt selfish mining strategies.

Investors must weigh the risks of holding versus selling, considering how other market participants might behave.

Institutions deliberate on whether to adopt, regulate, or avoid Bitcoin, influenced by competitors' actions.

Developers and node operators make strategic decisions regarding network upgrades and protocol changes, shaping the system’s long-term trajectory.

Each of these decisions affects the broader network and the value proposition of Bitcoin itself.

By applying game theory, we can not only explain the current state of Bitcoin’s adoption but also gain forward-looking insights into its potential evolution. As the landscape continues to shift due to technological advancements, regulatory changes, and macroeconomic forces, understanding the strategic behaviors of Bitcoin’s participants becomes essential for assessing its future trajectory.

The Prisoner's Dilemma in Bitcoin

The Prisoner's Dilemma is a foundational game theory model that illustrates how rational individuals, acting in their own self-interest, can make decisions that lead to suboptimal outcomes for both parties. The classic setup involves two prisoners, detained separately, each given the same choice:

Defect (betray the other): If one defects while the other remains silent, the betrayer walks free while the other serves a harsh 5-year sentence.

Mutual Cooperation (remain silent): If both remain silent, they each receive a light 1-year sentence.

Mutual Defection: If both defect, they each serve 3 years—worse than the cooperative outcome but better than being the only one betrayed.

The dilemma arises because, although cooperation yields the best collective outcome, individual incentives push both players toward defection, leading to a worse result. The lack of enforceable trust—where no external authority guarantees adherence to cooperation—ensures that uncertainty dominates decision-making.

How does it apply to Bitcoin?

Bitcoin’s adoption and market dynamics mirror the Prisoner’s Dilemma on a grand scale. Investors, institutions, and entire nations are participants in what could be termed the Bitcoin Dilemma—a strategic game where each player must decide whether to accumulate Bitcoin now or delay in hopes of a more favorable entry point. The risks and incentives at play are strikingly similar:

If a single entity adopts Bitcoin early while others hesitate, it gains a significant advantage.

If all entities adopt simultaneously, they benefit from network effects, liquidity, and shared security.

If no one adopts, the opportunity for a decentralized financial system is lost.

For institutional investors, the dilemma is even more pronounced. Banks and investment firms must weigh the potential upside of integrating Bitcoin into their financial products against regulatory risks, volatility, and uncertainty about its long-term adoption. If they move too early, they risk exposure to uncharted regulatory frameworks; if they wait too long, they risk losing market share to more forward-thinking competitors.

Bitcoin’s trustless architecture—where transactions and network security rely on mathematical incentives rather than centralized oversight—introduces a unique solution to the dilemma. Game-theoretic incentives encourage rational actors to cooperate, even in the absence of trust. Over time, as adoption increases, defecting from Bitcoin becomes less attractive, reinforcing a cycle of network growth and strategic alignment.

Nash Equilibrium and the Global Bitcoin Standard

Imagine a world where Bitcoin becomes the global standard for value exchange. In this large-scale Coordination Game, major financial institutions, sovereign wealth funds, and governments adopt Bitcoin simultaneously. The payoff for each player depends on whether they coordinate their adoption efforts.

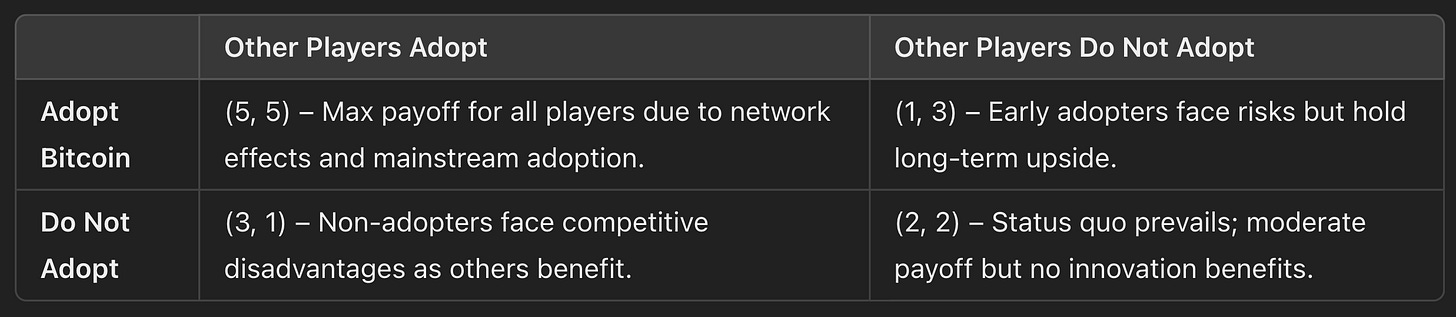

When players act collectively, they achieve superior outcomes compared to acting independently. This dynamic can be visualized through a simplified payoff matrix (Table 1), where the greatest rewards arise from mutual adoption, fostering a widely accepted, stable currency that boosts international trade, financial stability, and investment flows.

Table 1: Payoff Matrix for the Coordination Game

In this matrix:

(5, 5): When both players (countries, institutions, or large corporations) adopt Bitcoin, they enjoy the highest payoff due to enhanced liquidity, global acceptance, and first-mover advantages.

(1, 3): If one player adopts while the other does not, the adopter takes on higher risks but potentially reaps future gains, while the non-adopter captures only moderate benefits through secondary effects.

(3, 1): Conversely, if the other player adopts while the first does not, the non-adopter is left behind, missing out on competitive advantages.

(2, 2): If neither adopts, the payoff is moderate, reflecting the continuation of the traditional financial system.

The Nash Equilibrium in Bitcoin Adoption

Game theorists recognize that coordination games often lead to multiple Nash equilibria—stable states where no player benefits from changing their strategy if the other does not. In the Bitcoin adoption game, both (2, 2) (no adoption) and (5, 5) (full adoption) represent Nash equilibria.

However, the higher-reward equilibrium occurs when all players adopt, creating a positive-sum outcome driven by network effects, capital inflows, and improved liquidity. The challenge lies in overcoming short-term incentives to defect (not adopting) and achieving mass coordination.

HODLers and the Push Toward Nash Equilibrium

From a mathematical perspective, HODLing (holding Bitcoin long-term) can be viewed as a coordinated strategy aimed at pushing the market toward the higher-reward equilibrium. If all Bitcoin holders collectively commit to long-term holding, the circulating supply diminishes, creating scarcity-driven upward price pressure. Theoretically, this forms a self-reinforcing cycle, rewarding all participants through price appreciation—a Nash equilibrium where mutual cooperation yields the highest collective payoff.

However, in practice, financial markets rarely adhere to such pristine mathematical models. Human behavior introduces irrationality, fear, and short-term incentives that erode the cooperative structure.

Consider the Mt. Gox bankruptcy resolution, where approximately 140,000 previously lost Bitcoin were set to be distributed to creditors. The sudden prospect of $9 billion worth of BTC entering the market triggered widespread fear, despite the event being a known, foreseeable event.

In this scenario:

Investor A, anticipating the sell-off, decides to defect from the collective HODL strategy by selling early, aiming to preserve their profits.

Investor B, witnessing A’s defection, follows suit, seeking to avoid losses by selling preemptively.

The cascade effect drives down Bitcoin’s price, reducing market stability—a direct consequence of asymmetric information and short-term incentives.

Economists would label this behavior as a textbook example of the Prisoner's Dilemma: despite the theoretical benefits of collective cooperation (HODLing), individual players defect out of fear of missing out (FOMO) or fear of loss, triggering market instability.

The Mt. Gox case underscores how, despite the theoretical elegance of game theory models, real-world markets are driven by uncertainty, distrust, and individual incentives. Even when collective cooperation offers the highest payoff, players often choose self-preservation over long-term communal gain.

Nation Game Theory to Practice: First-Mover Advantage in Bitcoin Reserves

El Salvador's decision to adopt Bitcoin as legal tender in 2021 exemplifies a real-world Coordination Game. The country’s strategic move sought to boost financial inclusion, reduce remittance costs, and attract foreign investment. By positioning itself as an early adopter, El Salvador aimed to capture the potential upside of Bitcoin’s appreciation and its possible role as a future reserve asset.

Despite initial skepticism from international organizations, including the IMF and World Bank, El Salvador’s Bitcoin experiment is gradually shaping the country’s financial landscape. According to government data, over 70% of the population remains unbanked, making the adoption of Bitcoin—via digital wallets like Chivo—a bid for greater financial participation. Furthermore, by mining Bitcoin using geothermal energy from volcanoes, the country is creating a narrative of sustainable innovation while generating sovereign crypto reserves.

If Bitcoin ultimately becomes a global reserve currency, El Salvador’s early adoption could confer significant economic advantages, akin to the benefits enjoyed by countries that established large gold reserves before the collapse of the Bretton Woods system. The government’s stated ambition of transforming El Salvador into the “Singapore of Latin America” reflects its broader goal of becoming a financial hub by leveraging its Bitcoin-first policy.

Bitcoin as a Political Strategy

The game-theoretic implications of Bitcoin have extended beyond small nations to major geopolitical players. In the run-up to the 2024 U.S. presidential election, Bitcoin became a campaign issue, signaling its growing political and economic influence. Both Donald Trump and former Vice President Kamala Harris made strategic appeals to the Bitcoin community, recognizing its expanding voter base and the industry’s financial power.

Trump, in particular, floated the idea of establishing a Bitcoin strategic reserve, a proposal aligned with the vision of Wyoming Senator Cynthia Lummis, a prominent Bitcoin advocate. Such a reserve would mark a significant shift in U.S. monetary policy, effectively positioning Bitcoin alongside gold and foreign currencies in the nation’s sovereign holdings. This move, if implemented, could trigger a first-mover advantage at the nation-state level, forcing other governments to accelerate their own Bitcoin strategies.

Corporate Game Theory: MicroStrategy’s Strategic Adoption

The game-theoretic dynamics of early adoption are equally evident in the corporate sector. MicroStrategy, a Virginia-based business intelligence firm, was the first major publicly traded company to implement a dedicated Bitcoin acquisition strategy. Under the leadership of Co-Founder and Chairman Michael Saylor, MicroStrategy made its inaugural Bitcoin purchase in August 2020, acquiring $425 million worth of BTC.

By February 2025, the company’s Bitcoin reserves had grown to 471,107 BTC, valued at approximately $49.32 billion. This aggressive accumulation not only transformed MicroStrategy into a quasi-Bitcoin ETF but also triggered a competitive FOMO effect. Other publicly traded companies, including Tesla, Semler Scientific, Metaplanet, and KULR Technology Group, followed suit, adding Bitcoin to their corporate treasuries.

Strategic Adoption and Competitive Response

The company’s early and continuous BTC purchases forced competitors to weigh the risks of balance sheet devaluation—due to inflation and fiat depreciation—against the potential benefits of early Bitcoin adoption.

The dynamic between strategy and response illustrates the feedback loop inherent in game theory. MicroStrategy’s early bet created a precedent, altering the payoff matrix for other corporations. Inaction carried the risk of missing out on future gains, while proactive adoption offered the possibility of long-term treasury appreciation. The ensuing corporate adoption wave highlights how game theory models, such as the Coordination Game and FOMO-driven herd behavior, are playing out in real time across the financial sector.

At the nation-state or corporate level, Bitcoin adoption is evolving into a multi-player strategic game. The decisions of early adopters—be they governments or corporations—can significantly alter the equilibrium dynamics, forcing others to adjust their strategies.

The Long-Term Implications: Bitcoin as the Default Store of Value

Bitcoin's adoption, when examined through the lens of game theory, is rooted in its potential to prevent fiat currency debasement. Unlike traditional fiat currencies, which can be printed at will by governments, leading to inflationary manipulation, Bitcoin's fixed supply shields it from the effects of monetary debasement. Governments create a "money illusion" by printing more money, where citizens experience spending before they fully comprehend the subsequent devaluation of their currency. Bitcoin, on the other hand, offers a non-inflationary alternative, removing the ability for any centralized authority to dilute its value.

This fixed supply feature makes Bitcoin a natural focal point for individuals.As the first and most widely recognized cryptocurrency, stands out in its prominence and uniqueness. It has become the default store of value, akin to digital gold. Investors seeking inflation hedges or safe havens naturally gravitate toward Bitcoin because of its strong brand recognition and largest market capitalization. The network effect amplifies its dominance; as more people adopt it, its value and influence continue to grow.

In times of market uncertainty, Bitcoin has consistently become the "flight to safety" asset within the crypto market. This reinforces its status as the flagship digital asset, making it the de facto choice for both institutional and retail investors alike. The institutional adoption further solidifies its position, as major players continue to see it as a long-term hedge against economic instability.

A Paradigm Shift in Trust and Collaboration

Bitcoin's underlying genius lies in its ability to foster trust in an inherently distrustful system. It provides a decentralized consensus mechanism that enables collaboration without central authorities, fundamentally transforming the way we think about trust and collaboration. This is not merely a financial asset or a trading tool; Bitcoin represents a paradigm shift in how human collaboration and governance can be structured. By decentralizing control and entrusting it to the network participants, Bitcoin challenges traditional financial systems and governance models, offering a truly peer-to-peer solution.

As adoption grows, leading institutions like BlackRock, Fidelity, and Ark have invested substantial resources into educating and marketing to potential Bitcoin investors. However, Bitcoin itself is not controlled by any central organization. It operates as a decentralized protocol—open-source software that lacks an owner, management team, or marketing department to spearhead its promotion. Despite this, it has managed to achieve global recognition and grow into a dominant force in the financial landscape.

By analyzing Bitcoin through the game-theoretic framework, we can gain a more nuanced understanding of its strategic forces and resilience. Game theory provides a rich context for Bitcoin’s influence, with applications spanning personal, social, business, and even nation-state levels. Bitcoin is not just a speculative asset but a revolution in trust and collaboration that could reshape global finance by reducing reliance on intermediaries and redistributing economic power. To view Bitcoin solely as a speculative investment overlooks its transformative potential in constructing a new financial architecture.

The Nash Equilibrium Achieved: Optimal Strategy is to Buy and Hold Bitcoin

In game-theoretic terms, Bitcoin’s optimal strategy in the global reserve asset race mirrors the Nash equilibrium—where the best course of action is for all participants to buy and hold Bitcoin indefinitely. This strategy minimizes the risk of being left out in a scenario where Bitcoin becomes the predominant global store of value.

The cost of adoption is relatively small compared to the potential benefits. As Bitcoin continues to recover from long bear markets and reaches new all-time highs (ATHs), its adoption as a global reserve asset becomes increasingly appealing. Countries that adopt Bitcoin early are poised to reap substantial rewards, irrespective of their current economic or military power. In this context, the decision to adopt Bitcoin is not just a speculative bet, but a forward-looking strategic move.

More importantly, Bitcoin’s network effect means that once one major actor—whether a government, central bank, or financial institution—publicly adopts Bitcoin, others will likely follow suit. The cost of non-participation would be too great, as failing to adopt Bitcoin could result in being excluded from the new global reserve asset framework. The logic of game theory dictates that not adopting Bitcoin at this stage would be illogical.

The Forward-Looking Decision - Seizing the Future or Missing the Revolution?

In investing—whether in Bitcoin, stocks, or real estate—the most powerful decisions are those made with foresight. As the saying goes, the best time to buy Bitcoin was when it first hit $1, but the second-best time is today. By embracing Bitcoin now, investors and nations alike are positioning themselves to become architects of a transformative shift in the global financial system.

Bitcoin adoption isn’t just a path to short-term profit; it’s a chance to secure a seat at the table of tomorrow's economic landscape. As its influence expands, and more governments and institutions join the movement, early adopters will hold an irreplaceable strategic advantage. Investors of Bitcoin today declare their faith in its enduring value as a store of wealth, a decision that will echo for generations to come. The question isn’t whether to invest, but whether to be part of history or watch it unfold.