How Prediction Markets Create Tradable Edge

In the stock market, the crowd is often wiser than the smartest individual—provided the crowd has money on the line.

For investors and analysts, the universal challenge is forecasting the future. We rely on a host of traditional tools to navigate uncertainty, from the consensus estimates of Wall Street economists to specialized instruments like the CME FedWatch tool that gauges future central bank policy. Yet, these established methods are increasingly showing their limitations in a complex and fast-moving global economy, often exhibiting systematic biases such as herding and delayed information incorporation, which can inflate mean absolute errors (MAE) by 20-50% during volatile periods.

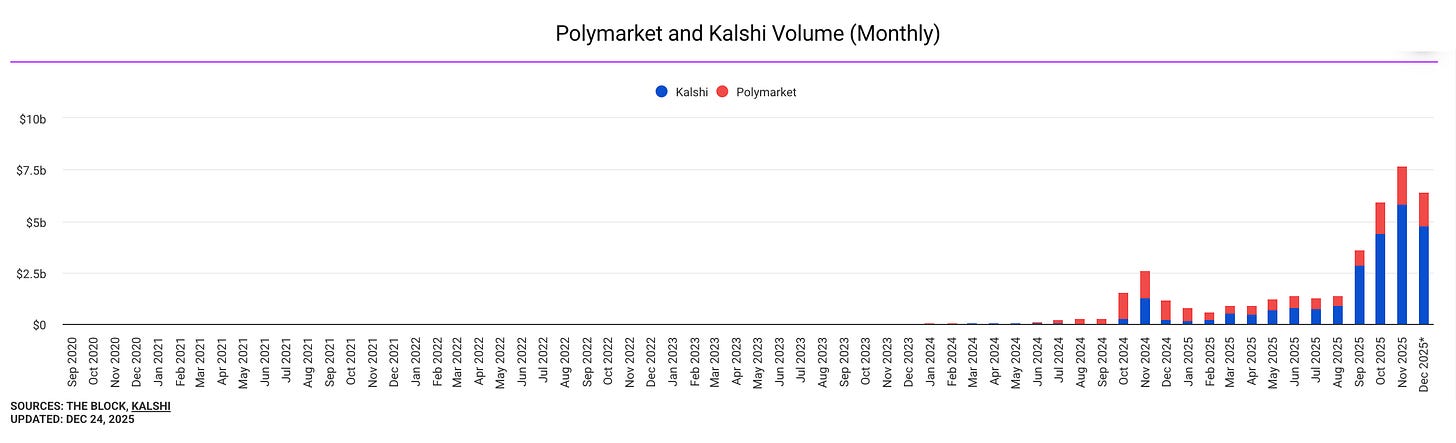

A different, more powerful forecasting engine is emerging, driven not by a small group of experts but by the collective “wisdom of the crowd” with real money on the line. These are prediction markets, and a growing body of evidence shows they are consistently outperforming their established alternatives, providing clearer, faster, and more accurate signals on everything from inflation to elections.

By leveraging incentivized trading, these platforms aggregate dispersed information into probabilistic forecasts that reduce variance and enhance predictive power.