Silver’s Price Appreciation

Paper promises evaporate when physical reality demands its due.

For a long time, the silver market ran on an unspoken understanding: very few people actually wanted to take delivery of the metal. What they wanted was exposure - futures contracts, a way to bet on silver’s price without the logistics of dealing with physical bars. Inventories at big exchanges like COMEX were just proof the metal existed somewhere, not that it would ever be moved. The whole system operated on routine and, frankly, a bit of complacency.

That’s changed.

Just look at what happened this month, at the beginning of 2026. In a single week, traders withdrew about 33 million ounces of silver from COMEX’s registered stockpiles—over a quarter of what was there. But the real story isn’t just the amount but the urgency whats striking. Holders of March futures actually paid extra to shift their contracts to January, just to secure faster access to the metal. This wasn’t about chasing yield or quick arbitrage. They wanted actual silver, immediately.

Moves like that point to a structural shift—not runaway speculation.

When Paper Stops Meeting Demand

Futures markets work because everyone trusts they’ll have the choice—not the obligation—to take delivery. But when buyers start insisting on taking physical metal now instead of rolling contracts forward, pricing dynamics change.

Silver is now in backwardation. In simple terms: the spot price is higher than future delivery prices. This isn’t a sign of bullish sentiment. It means there’s a shortage of metal available now, and buyers are willing to pay up for certainty. That’s unusual for silver. When it happens, it tends to signal a major move—like the jump to $49 in 2011. This time, the squeeze is about tight physical supply, not just nerves.

China Locks Up Its Silver

In January 2026, China changed the game. They reclassified silver as a strategic material. Now, only 44 firms are allowed to export, and these companies need serious refining capacity and large credit lines (think $30 million or more). This is critical because China supplies about two-thirds of the world’s refined silver. By restricting exports, Beijing isn’t just reacting to short-term volatility—they’re signaling a long-term policy shift that won’t be undone easily.

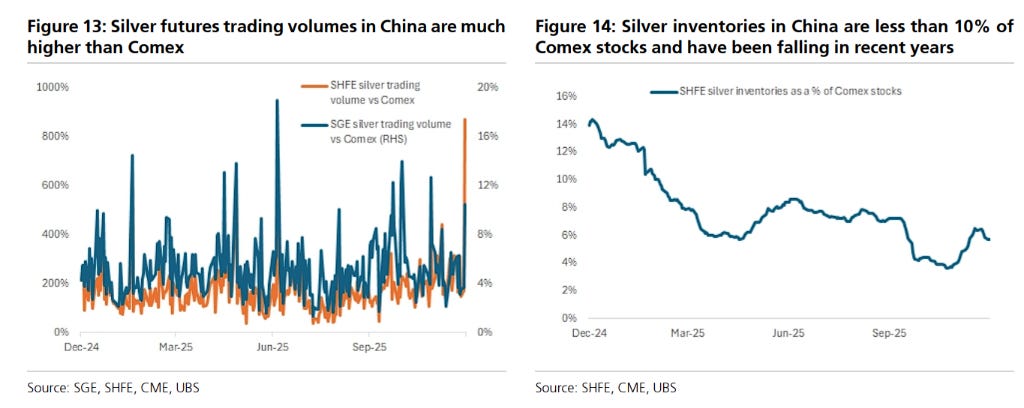

Physical and Paper Markets Diverge

Prices aren’t matching up globally anymore. Physical silver commands a strong premium over “paper” prices in key hubs:

Shanghai: 12–13% higher than Western benchmarks

Dubai: premiums up to 40%

Japan: secondary market premiums near 60%

Meanwhile, on COMEX, there are still hundreds of paper claims per actual ounce—about 356 to 1. That kind of leverage worked as long as no one asked for delivery. Now, with demand for physical metal surging, the foundation is looking shaky.

A Persistent Supply Deficit

Silver has trailed demand for five years running. The shortfall is roughly 820 million ounces since 2021—almost a full year’s global mine output. And don’t expect higher prices to fix this overnight. Most silver is mined as a byproduct of extracting other metals like copper or gold. Those miners aren’t increasing output just because silver’s price is up.

So even if the price jumps, supply creeps.

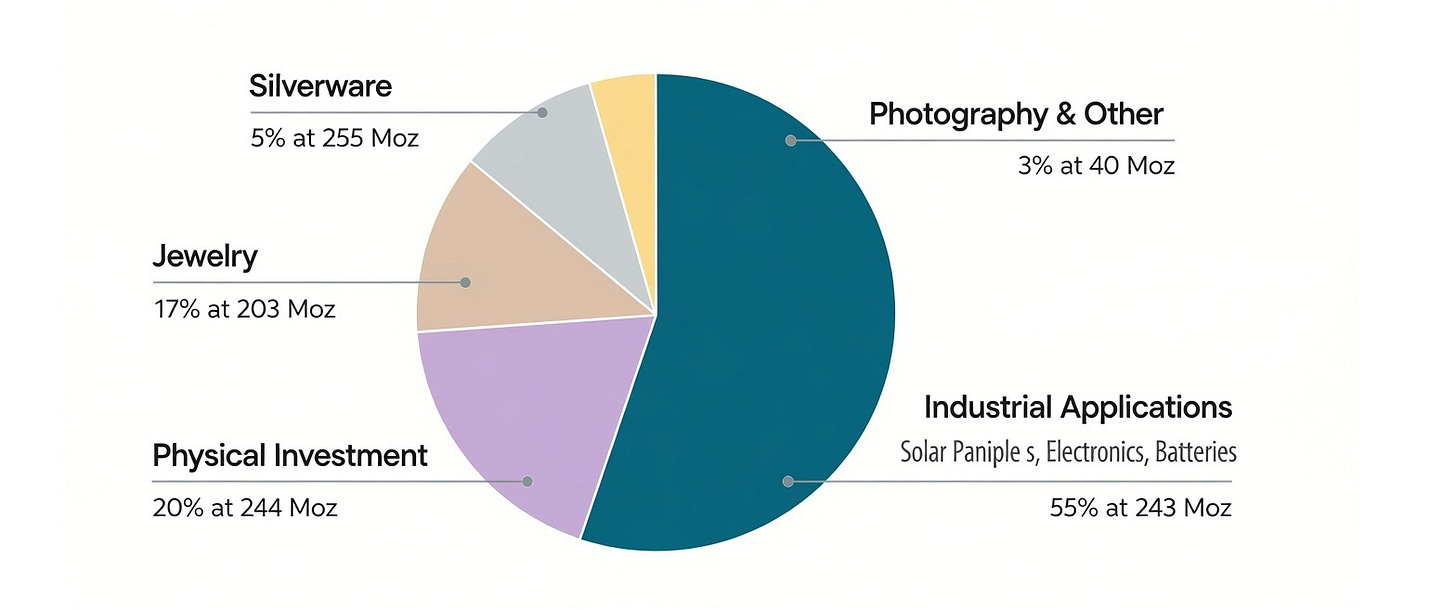

Industrial Demand Isn’t Going Anywhere

Silver isn’t gold. People don’t just stash it away for the future. Close to 60% of silver demand is industrial—solar panels, EVs, semiconductors, data centers. These are essentials. Manufacturers don’t hit pause because silver gets pricey. They pay up and keep moving. That’s why silver’s price can spike so quickly: investment demand can surge if confidence in money falters, industrial demand stays solid, and supply can’t catch up. The only real answer is for prices to reset higher.

The Gold-Silver Ratio: Basic Calculation

Check the gold-to-silver ratio—it’s dropped from over 100:1 to around 50:1, and sometimes even tighter. History shows this ratio can fall to 15–20:1 when things truly rebalance. If gold stays firm and silver gets harder to find, the math alone drives silver’s price much higher. This isn’t speculation—it’s straightforward calculation.

Silver’s New Landscape

Right now, silver serves many roles:

It’s a core industrial material, and that demand isn’t fading.

It’s a monetary asset, especially when trust in the system wavers.

And now, it’s a strategic commodity—just look at China.

The silver market’s structure has changed. And thats the new reality.

When traders pay extra just to get silver sooner, that’s not speculation that’s urgency. Pulling 33M ounces in a week looks like people wanting the real metal, not just paper exposure. It feels like confidence in the system is being quietly tested.

Great article on the changed realities of the global silver market!

One additional data point: Legendary gold and silver investor and self-made billionaire Eric Sprott believes that the global silver price finding mechanism will move from COMEX/LBMA to Shanghai.

Eric Sprott recently said in an interview:

✅“The Shanghai’s always been... a delivery market. And of course they’re the largest producer of silver and they’re the largest consumer of silver.”

✅His conclusion on where the price is set is clear: “Asia will determine the price for sure.”

For me, I look at Shanghai, to see where the silver price journey is going. Just my 2 cents.

Not investment advice.