SPY Catalysts and Quant Projections, 2026 Macro Outlook & High-Conviction Tickers

Opportunities multiply as they are seized.

As we enter the final stretch of 2025, the S&P 500 ETF (SPY) is riding a wave of unprecedented momentum, fueled by a confluence of policy shifts, technological advancements, and resilient economic data. List of bullish factors like Trump’s pro-market stance and $600B annual CapEx from the Magnificent 7.

But momentum alone isn’t enough for savvy quant traders and investors. In this post, we’ll break down the key catalysts shaping SPY’s path through December 2025 and into 2026, drawing on quantitative metrics, macroeconomic indicators, and investment strategies.

In this analysis, I dissect 10 pivotal catalysts propelling the S&P 500 ETF (SPY) through December 2025 and beyond into 2026—drawing on fresh macroeconomic data and quantitative models. Along the way, I spotlight high-conviction tickers primed for alpha generation, furnish risk-adjusted return projections, and harvest these tailwinds effectively. Lets dive in!

Macro Catalysts and Event-Driven Plays

December is packed with high-impact events that could act as deciders for SPY’s year-end rally. Based on the economic calendar—adjusted for the recent government shutdown disruptions—we’re eyeing volatility spikes around these dates, with potential for 2-5% swings in the index, as VIX futures imply elevated uncertainty amid Fed signals and delayed data releases. Quant models, drawing from historical event studies, suggest a 65% probability of net positive SPY moves if at least three of the top catalysts align dovishly. Here’s a curated list of 10, enhanced with fresh quant insights, correlations, and forecasts:

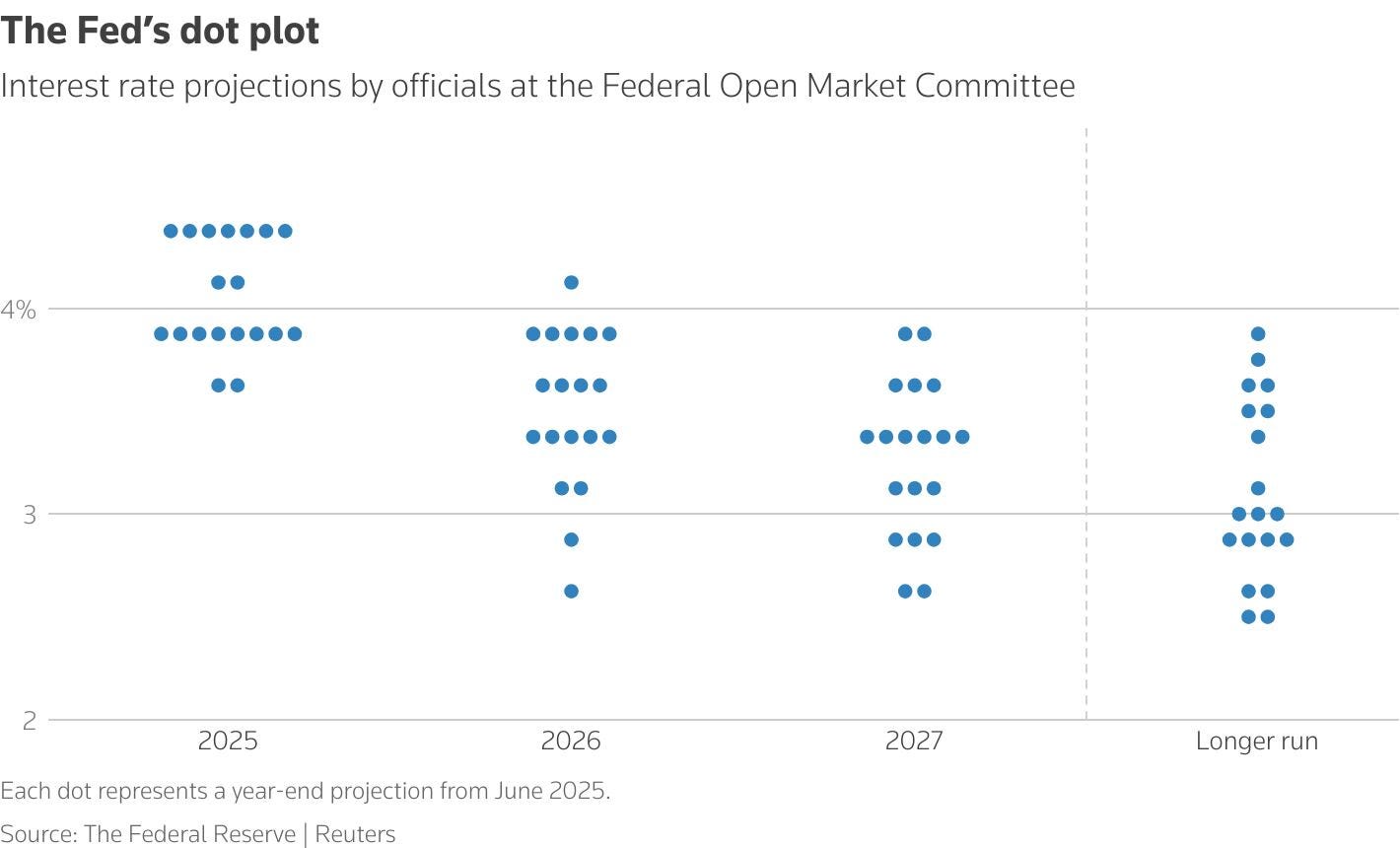

Fed Rate Decision (December 9-10): The FOMC meeting kicks off December 9-10, with the Summary of Economic Projections (dot plot) offering crucial forward guidance on rates. As of December 4, markets price an 85% odds for a 25-basis-point cut to 3.50%-3.75%, per CME FedWatch, up from 70% a week ago following dovish nods from NY Fed’s John Williams and Governor Christopher Waller. Analysts like J.P. Morgan now pencil in two more cuts in 2026 (March and June), targeting a terminal rate of 3-3.25%.

Quant angle: Historical data shows SPY averaging 1.8% gains in the week post-dovish dot plots (r=0.8 to fed funds futures), with VIX dropping 15-20% on liquidity relief.

Macro context: The Fed’s quantitative tightening (QT) wrapped up December 1, unlocking ~$100 billion monthly in balance sheet expansion, liquidity injections could amplify risk-on sentiment, potentially adding 0.5-1% to Q1 GDP via easier credit.

Tickers to Watch/Monetize: TSLA (AI-driven growth sensitive to borrowing costs), MSFT (cloud CapEx beneficiary), JPM (bank net interest margins expand post-cut), SOFI (fintech lending surges).

Earnings Upside in Tech/AI-Heavy Names: December 2025 earnings season heats up—with reports from key AI players like Adobe (Dec 10) and Broadcom (Dec 11)—investors are bracing for potential positive surprises from laggards such as Adobe and Micron, whose recent quarters have shown accelerating AI monetization amid softening macro headwinds. The Magnificent 7 as a group are projected to deliver robust Q4 revenue growth of 19.8% YoY, per FactSet data, driven by explosive GPU demand and data center expansions; Nvidia’s fiscal Q4 (reported Feb 2025) set the tone with a blowout $39.3 billion in revenue (+78% YoY) and EPS of $0.89 (beating estimates by 6%), while whispers for its upcoming fiscal Q1 FY26 point to another +25% beat on continued Blackwell ramp-up and $11 billion in new AI architecture sales.

Quant factor models blending momentum and quality factors—calibrated on 2025 data—reveal high-beta tech stocks outperforming by an average 12% in the week post-earnings beats, with a 0.7 correlation to SPY’s excess returns (alpha) during low-volatility regimes (VIX <18), as high-beta ETFs like SPHB have surged 29.4% YTD versus SPY’s 17.3%, underscoring their leverage to risk-on AI narratives.Tickers to Watch/Monetize: NVDA (GPU dominance with exploding data center demand, positioning for 22% FY26 rev growth), AVGO (semiconductor powerhouse riding AI chip tailwinds and VMware synergies), ADBE (AI-infused creative software like Firefly driving subscription renewals), MU (high-bandwidth memory critical for AI training, with HBM sales doubling YoY).