The Dollar’s 2026 Playbook: Practical Strategies for Investors

The U.S. dollar is the world’s currency. It’s not just America’s currency.

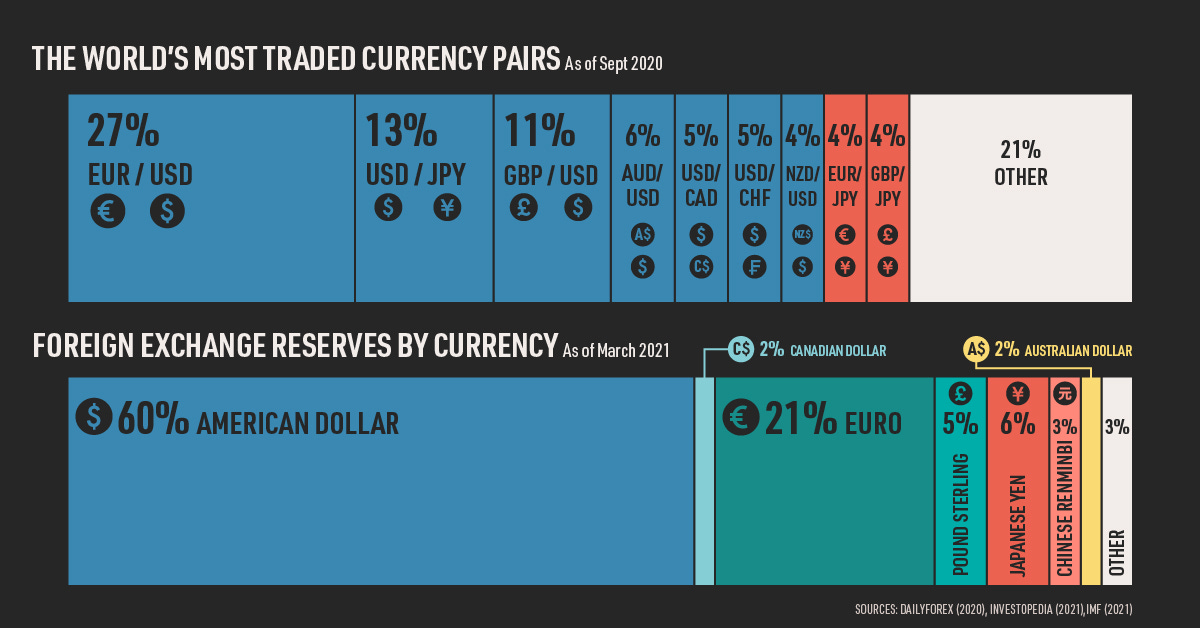

As we enter 2026, the U.S. dollar has just endured its sharpest annual decline in eight years, with the DXY index falling approximately 9-10% in 2025 amid narrowing interest rate differentials, fiscal uncertainties, and shifting global capital flows. Yet, despite these headwinds and ongoing discussions of de-dollarization, the latest Federal Reserve analysis reaffirms the dollar’s unchallenged preeminence in global finance—holding a stable ~57% share of disclosed foreign exchange reserves and dominating international transactions, invoicing, and innovative assets like stablecoins (now exceeding $300 billion in market cap, nearly all USD-pegged).

For investors, this opens up high-conviction opportunities even with all the uncertainty. You can build smarter currency hedging models or jump on gaps in FX valuations. In this post, I’ll break down the Fed’s 2025 Edition report, bring you up to speed with what’s happening early in 2026, and lay out clear, practical strategies you can actually use to keep your portfolio ahead.