Weekly Market Edges That Still Work

A Playbook for Seasonality That Persists

Markets breathe in rhythm. News cycles, institutional flows, and retail habits all stack into patterns that repeat—not perfectly, but often enough to be traded. Day-of-the-week effects aren’t new; academics have studied them since the 1970s.

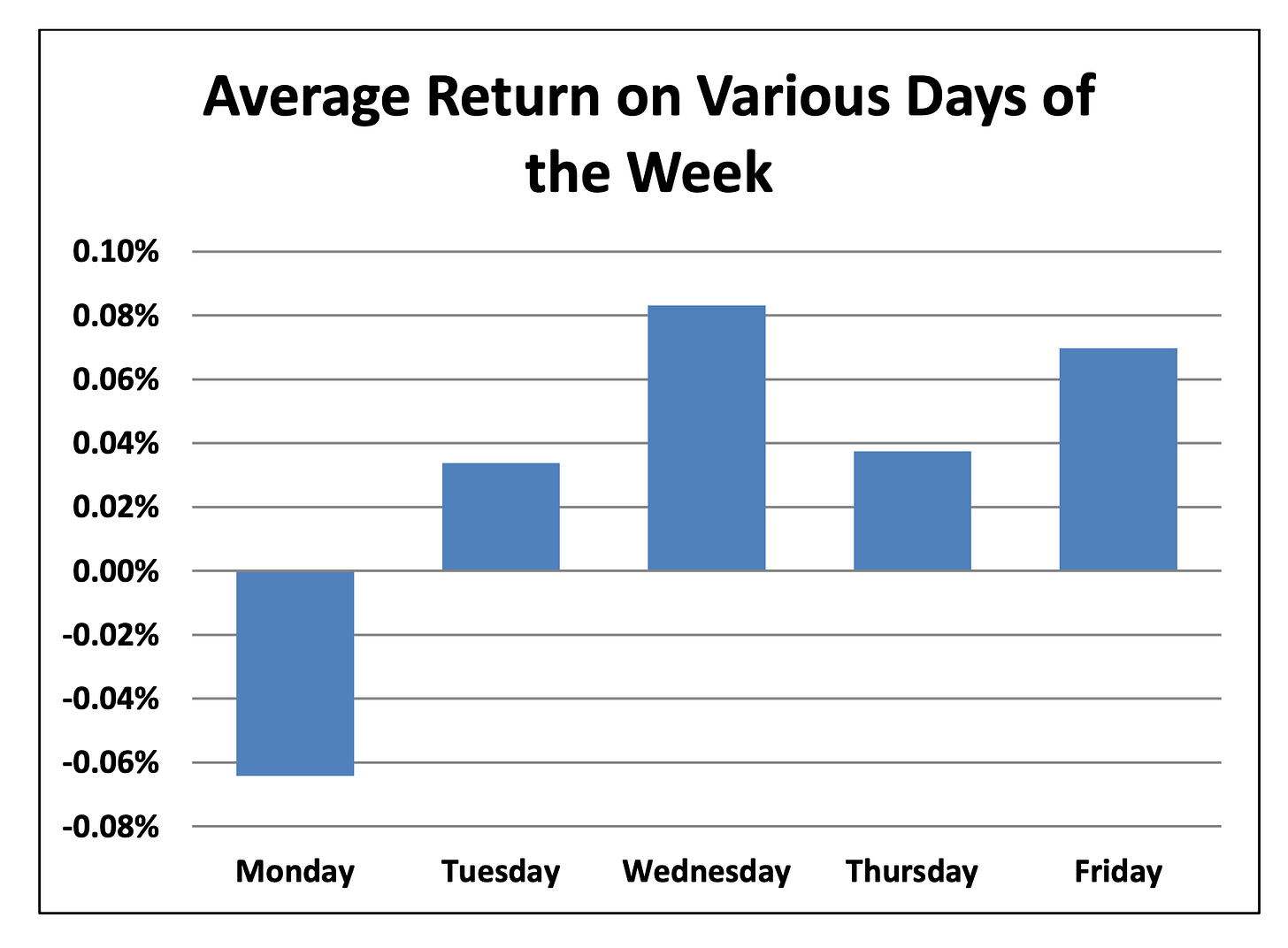

In fact, calendar effects are some of the oldest and most persistent findings in market research. And they’re counterintuitive. You’d expect Monday to deliver three times the “normal” return—after all, it’s three trading days since Friday’s close. Instead, the data shows the opposite: Mondays tend to lag, while other days consistently pick up the slack.

Most investors stop there, treating anomalies as trivia. But if you think like a trader, you push further: you take these recurring flows, pressure points, and quirks, and turn them into actionable frameworks.

Below, I’ll walk you through five tested, executable strategies—one for each weekday. Think of them as practical building blocks you can test, refine, and scale.