Quantitative Momentum Strategy

🔓 Unlock the Systematic Edge Used by Quants and Hedge Funds

Simplicity or Complexity? The Real Tradeoff in Trading System Design

When it comes to building trading systems, two camps dominate.

One favours simplicity—clean rules, easy testing, fast execution.

The other leans into complexity—high-dimensional models, machine learning, and statistical nuance.

So which is better?

After years of research, I’ve tested both extremes—strategies built on a single moving average, others trained on thousands of variables. Some backtests ran in seconds. Others took weeks.

Here’s what I learned:

Simplicity isn’t naive. Complexity isn’t always better.

But real edge often lives in the space between.

There’s strong evidence that well-handled complexity can surface true, tradable signals.

But for most traders—especially those managing their own capital—operational simplicity matters just as much as statistical power.

What you need is edge—distilled, explainable, and executable.

My Approach to Strategy Design

Someone asked if I use a checklist to greenlight new strategies—like “Sharpe > 1.8” or “Drawdown < 15%.” I get the appeal, but trading doesn’t work like that.

There’s no universal filter. Every decision depends on your context: your capital, risk tolerance, and bandwidth.

Here’s what I actually ask:

Is the edge explainable and durable?

If it’s rooted in behavioral or structural factors, it’s more likely to persist.Are biases ruled out?

I stress-test for look-ahead bias, survivorship bias, and faulty cost assumptions.Does data back the theory?

I want to see out-of-sample consistency—not just in-sample noise.Is execution realistic?

Great ideas die if you can’t trade them cleanly or cost-effectively.Can I run it sustainably?

If it eats up hours I don’t have, it’s a no—even if it works.

📈 Free Strategy

Momentum EMA Cross with Trend Filter

This strategy stands out by respecting the market’s natural rhythm. It waits for the long-term trend and short-term momentum to align—then capitalizes on the move with confidence.

Why This Strategy Works

Momentum alone won’t deliver results if it goes against the broader trend. This system filters for trend first—by using the 100-period EMA as a baseline—and only enters when short-term momentum kicks in.

You’re not guessing reversals or forcing trades. Instead, you enter when the market has already revealed its direction.

The logic is straightforward: price above the 100 EMA indicates an uptrend, while the EMA crossover confirms near-term momentum. Together, they create a robust entry condition backed by trend-following theory and momentum confirmation.

From a quantitative angle, this setup captures directional persistence without overfitting. It limits false positives in choppy markets and exits fast when momentum fades or risk increases. Like in surfing—you don’t paddle out in still water. You wait for a wave that’s already forming.

Strategy Rules ✔️

1. Trend Filter

Only trade long if current close > 100-period EMA.

2. Momentum Entry

Go long when 6 EMA crosses above 12 EMA

3. Exit Conditions

Exit when 6 EMA crosses back below 12 EMA

Or if price falls 3% below entry (stop-loss)

4. Execution Logic

Runs one bar at a time

Enters at close on valid signal

Exits on next close when exit condition is met

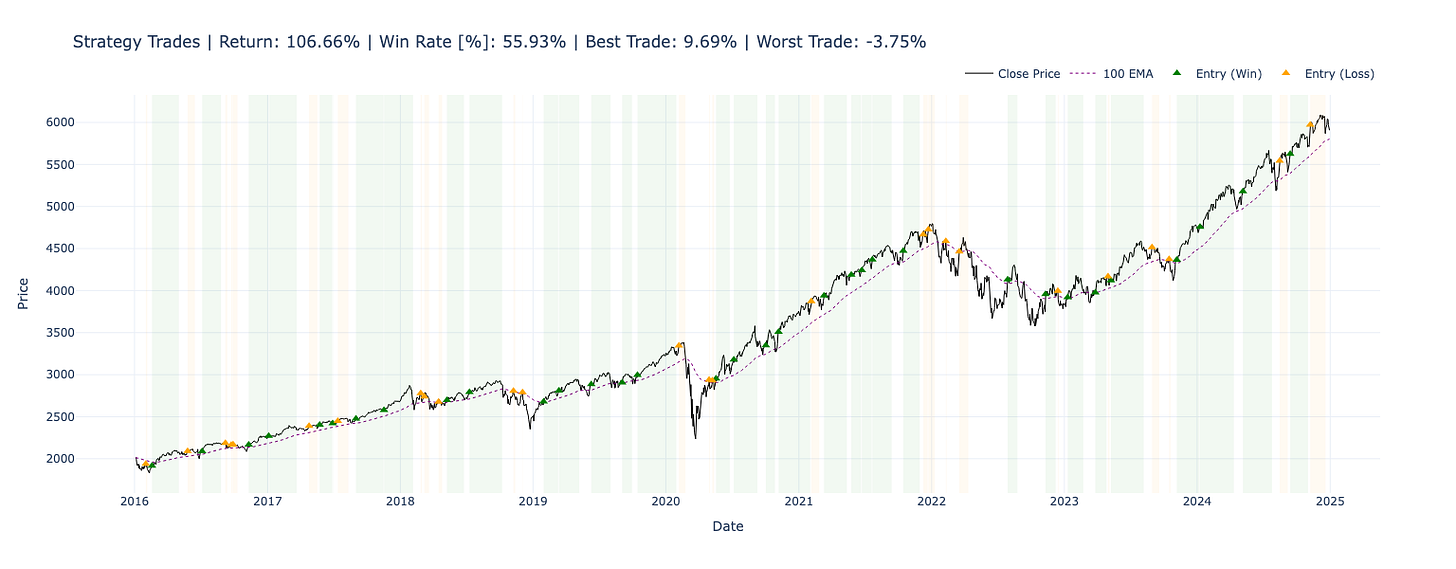

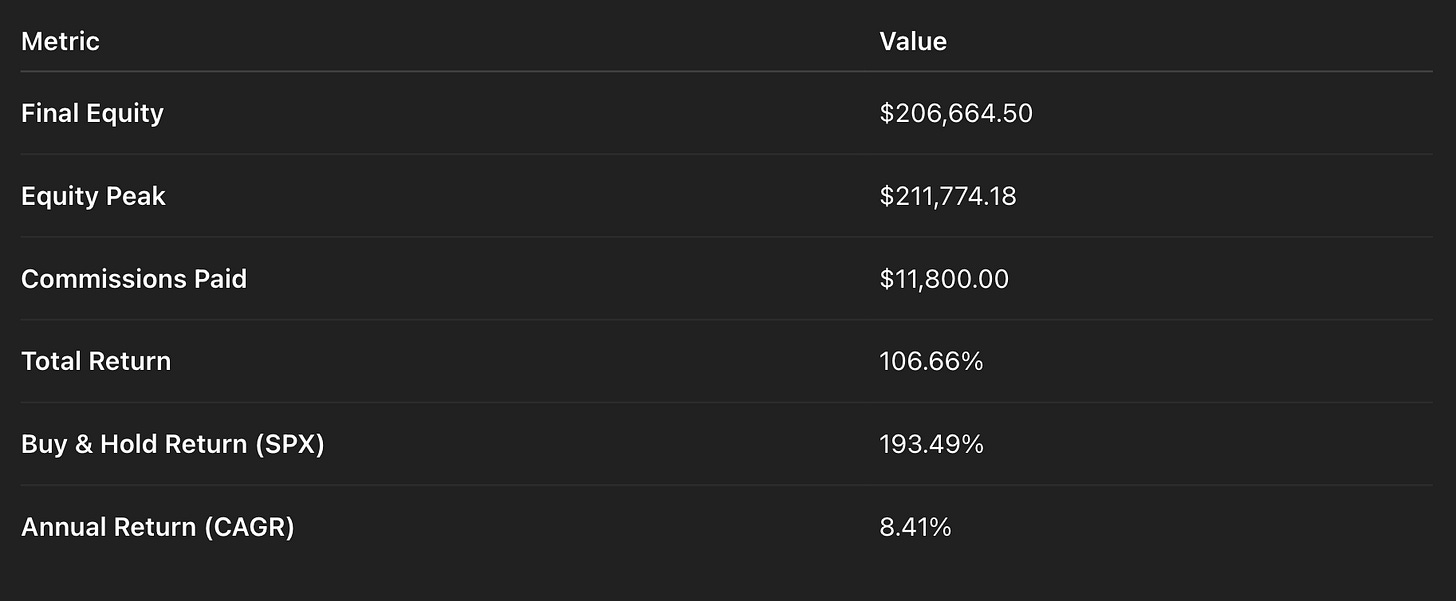

Backtest Results (S&P 500 | 2016–2024 📅)

This strategy doesn’t just survive the market—it handles volatility, controls drawdowns, and delivers steady returns through shifting regimes.

Start Date: January 4, 2016

End Date: December 30, 2024

Total Duration: 3,283 days (~9 years)

Exposure Time: 64.88%

Performance💰

Risk & Volatility

Trade Statistics

Strategy Metrics

✅ Key Strengths

Risk-Adjusted Edge: This strategy’s raw return is lower than buy-and-hold, but the max drawdown is three times smaller (11% vs. 34%). You compound steadily with less stress and lower capital risk.

Efficient Trade Selection: Only 59 trades over nearly 9 years means no overtrading. This selective approach preserves capital and transaction costs while keeping a strong statistical edge with a 56% win rate.

Profit Factor > 2.5: For every dollar risked, the strategy earns $2.50. This rare metric reflects high-quality entries and disciplined exits that consistently generate profits.

Time-Efficient: With about 65% market exposure, you stay out of the market a third of the time, reducing risk during uncertainty and freeing capital for other uses.

Low Behavioral Strain: The worst trade lost only 3.7%, far less than the S&P 500’s 33.9% max drawdown over the same period. With an average trade lasting about a month, this structure lowers emotional stress and helps you stay disciplined and confident.

Ideal for swing traders and systematic investors who want a repeatable, low-maintenance edge that avoids whipsaw markets. Works on stocks, indices, ETFs—anywhere trend persistence matters more than speed.

💡 Why This Matters to You

You don’t need to be a full-time quant to benefit from quantitative research and trade with confidence.

That’s why I built this system—not just with math and models, but with your time, capital, and attention in mind. It’s robust, tested, and simple enough to execute without second-guessing.

The free version gives you a solid edge. But if you’re ready for more?

Ready to Trade Smarter? The Full Strategy Is Waiting

The free strategy you just saw is real, tested, and useful. But it’s just the starting point.

Inside the full premium PDF 📘, I’ve included a premium strategy—one that I actually trade. It goes deeper on execution, adapts better across assets, and delivers stronger performance, backtested on S&P:

Free Strategy

✔ 106.6% total return

✔ 8.4% CAGR

✔ 0.14 Sharpe

✔ 3.6% avg drawdown

✔ 59 trades with 56% win rate

Premium Strategy

✔ 154.6% total return

✔ 10.9% CAGR

✔ 0.26 Sharpe

✔ 5.3% avg drawdown

✔ 169 trades with 62% win rate

The premium system trades more often, adapts faster, and scales better across BTC, ES, and volatility. It includes:

A complete, step-by-step premium trading strategy with full setup logic

Clear entry and exit rules using time-based logic

Stop-loss and time-exit conditions for disciplined risk control

Backtested performance metrics on the S&P 500 with real stats you can trust

Detailed analysis of strategy edge and predictive power

Mathematical explanation of why the system works

Visual examples of actual trades with annotated setup logic

Capital protection rules that manage drawdowns and position sizing

Practical execution tips rooted in real-world trading psychology

My personal mental checklist before entering any trade

Tools and habits to help you build confidence in live execution

A strategy you can run, test, and trade across Stocks, Futures & Crypto

This is the version I trust with capital. You can download it now. 👇

Still Thinking?

Use the free strategy. Test it. See the logic.

But if you want to stop second-guessing—and start trading like a pro—join the Premium tier now.

You’ll get the full playbook. You’ll trade with purpose.

And you’ll finally have a system built by a quant who actually uses it.